Kia 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

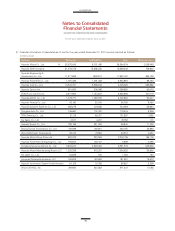

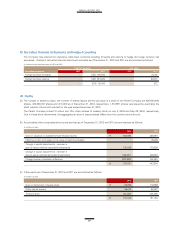

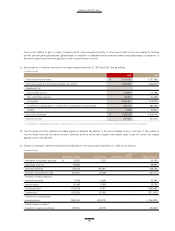

Changes in provisions for the years ended December 31, 2012 and 2011 are summarized as follows:

(In millions of won)

2012 2011

Provision of Provision of

warranty Other warranty Other

for sale provision Total for sale provision Total

Balance at January 1 ₩ 1,643,068 32,093 1,675,161 1,261,789 25,620 1,287,409

Increase 1,040,461 4,029 1,044,490 1,088,844 12,363 1,101,207

Usage (830,845) (3,907) (834,752) (708,128) (5,588) (713,716)

Increase due to business combination - - - 1,997 - 1,997

Other decrease (49,701) (850) (50,551) (1,434) (302) (1,736)

Balance at December 31 ₩ 1,802,983 31,365 1,834,348 1,643,068 32,093 1,675,161

Thereof non-current ₩ 1,274,578 27,932 1,302,510 1,144,463 27,713 1,172,176

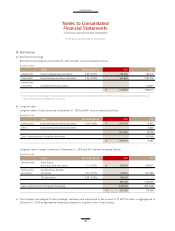

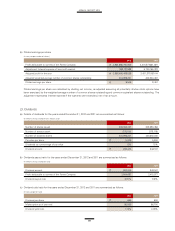

(a) The Company provides guarantees for certain customers’ financing relating to long-term installment sales. The oustanding amount

for which the Company has provided guarantees to the respective financial institutions is ₩ 9,345 million as of December 31, 2012.

These guarantees are covered by insurance contracts in which the Company is the beneficiary of the claim amount if the customer

defaults.

(b) As of December 31, 2012, one blank promissory note have been provided as collateral to Korea Defense Industry Association

(“KDIA”) for a performance guarantee on a contract.

(c) The Company is involved in several claims, litigations for alleged damages and product liabilities, which arose in the ordinary course

of business, as of December 31, 2012. Management is of the opinion that foregoing lawsuits and claims will not have a material

adverse effect on the Company’s financial position and results of operations since the incurrence is not probable nor amounts can

be reasonably estimated.

(d) In connection with long-term debt guaranteed by Hyundai Motor America, Inc. and Mobis America, Inc., Kia Motors Manufacturing

Georgia, Inc. (KMMG) should pay guarantor fees calculated at a rate of 0.15% per annum on the outstanding debt balance of

KMMG which should be paid biannually.

(e) On October 1, 2008, KMMG entered into an agreement with the West Point Development Authority to issue up to USD 1,100,000

thousand of taxable revenue bonds for a term through December 1, 2022, to fund the purchase of building, machinery and

equipment. As of December 31, 2012, approximately USD 757,216 thousand of taxable revenue bonds, net of redemptions have

been issued and sold to KMMG for these purchases.

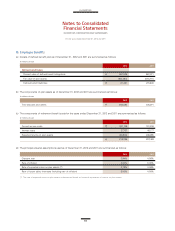

(f) The Company acquired 5.23% of Hyundai Engineering & Construction Co., Ltd’s shares along with terms of a contract that

the Company is prohibited from selling the shares, offering it as collateral or split for two years from April 1, 2011, the date of

acquisition. 939,407 shares of the Company, which is approximately 10% of the share acquired, were deposited at escrow account

for execution of the contract.

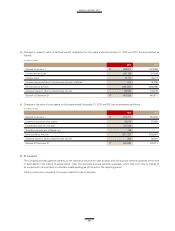

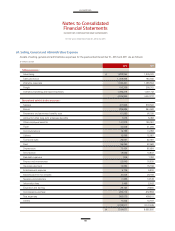

For the years ended December 31, 2012 and 2011