Kia 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

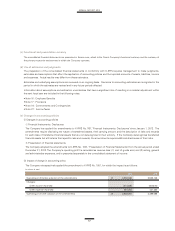

(n) Impairment of non-financial assets

The carrying amounts of the Company’s non-financial assets, other than assets arising from employee benefits, inventories,

deferred tax assets and non-current assets held for sale, are reviewed at the end of the reporting period to determine whether

there is any indication of impairment. If any such indication exists, then the asset’s recoverable amount is estimated. Goodwill and

intangible assets that have indefinite useful lives or that are not yet available for use, irrespective of whether there is any indication

of impairment, are tested for impairment annually by comparing their recoverable amount to their carrying amount.

The Company estimates the recoverable amount of an individual asset. If it is impossible to measure the individual recoverable

amount of an asset, then the Company estimates the recoverable amount of cash-generating unit (“CGU”). The recoverable

amount of an asset or a CGU is the greater of its value in use and its fair value less costs to sell. The value in use is estimated by

applying a pre-tax discount rate that reflect current market assessments of the time value of money and the risks specific to

the asset or CGU for which estimated future cash flows have not been adjusted, to the estimated future cash flows expected to be

generated by the asset or a CGU.

An impairment loss is recognized if the carrying amount of an asset or a CGU exceeds its recoverable amount. Impairment losses

are recognized in profit or loss.

An impairment loss is reversed if there has been a change in the estimates used to determine the recoverable amount. An

impairment loss is reversed only to the extent that the asset’s carrying amount does not exceed the carrying amount that would

have been determined, net of depreciation or amortization, if no impairment loss had been recognized.

(o) Leases

The Company classifies and accounts for leases as either a finance or operating lease, depending on the terms. Leases where

the Company assumes substantially all of the risks and rewards of ownership are classified as finance leases. All other leases

are classified as operating leases. In case of financial leases, at the commencement of the lease term, the Company recognizes

as finance assets and finance liabilities in its consolidated statements of financial position, the lower amount of the fair value of

the leased property and the present value of the minimum lease payments, each determined at the inception of the lease. Any

initial direct costs are added to the amount recognized as an asset. Also, minimum lease payments are apportioned between the

finance charge and the reduction of the outstanding liability. The finance charge is allocated to each period during the lease term

so as to produce a constant periodic rate of interest on the remaining balance of the liability.

The depreciable amount of a leased asset is allocated to each accounting period during the period of expected use on a systematic

basis consistent with the depreciation policy the lessee adopts for depreciable assets that are owned. If there is no reasonable

certainty that the lessee will obtain ownership by the end of the lease term, the asset is fully depreciated over the shorter of the

lease term and its useful life. The Company reviews to determine whether the leased asset may be impaired.

(p) Government grants

Government grants are not recognized unless there is reasonable assurance that the Company will comply with the grant’s

conditions and that the grant will be received. Government grants whose primary condition is that the Company purchase,

construct or otherwise acquire long-term assets are deducted in calculating the carrying amount of the asset. The grant is

recognized in profit or loss over the life of a depreciable asset as a reduction to depreciation expense.

Other government grants which are intended to compensate the Company for expenses incurred are deducted from related costs

over the periods in which the Company recognizes the related costs as expenses. Government grants which are intended to give

immediate financial support to the Company with no future related costs are recognized as government grant income in profit or

loss.

(q) Employee benefits

SHORT-TERM EMPLOYEE BENEFITS Short-term employee benefits are employee benefits that are due to be settled within 12

months after the end of the period in which the employees render the related service. When an employee has rendered service

to the Company during an accounting period, the Company recognizes the undiscounted amount of short-term employee benefits

expected to be paid in exchange for that service.

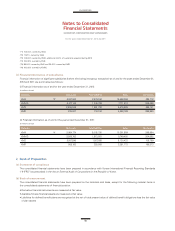

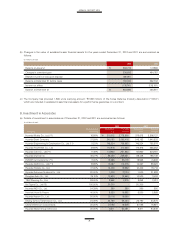

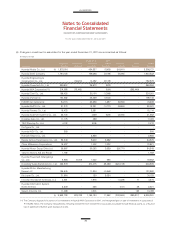

For the years ended December 31, 2012 and 2011