Kia 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Despite this progress brought about through our

unyielding efforts, Kia Motors posted domestic sales

of 481,000 units, down 2.2% year-on-year. This decline

was primarily due to a drop in domestic demand a result

of economic uncertainties at home. Specifically, sales

of sedans and RVs stood at 302,680 and 126,856 units,

respectively. The volume of sedan sales increased by 5.6%

but RVs saw their sales volume decline by 14.6% year-

on-year. The popularity of the K-series gained momentum

thanks to K5 and K7, with 76,910 and 19,957 units sold,

respectively. Meanwhile, 25,842 units of the K3 and 7,516

units of the K9 were sold. Overall, Kia’s domestic market

share stood at 31.2%, which is slightly up from the

previous year.

Turning Obstacles into Opportunities

In 2013, the gloomy outlook for the domestic auto market

is likely continue with a shrinkage in consumption due to

inflation arising from market uncertainty, in addition to the

end of the individual consumption tax cuts. Kia Motors,

however, will overcome the current difficult environment

by continuously intensifying its sales competency and

introducing fundamentals-oriented management. To this

end, we plan to intensively focus on fostering Kia Motors

as a premium brand through distinctive marketing,

boosting our corporate image through innovation in

customer services, enhancing staff confidence at

business sites, and strengthening our competitiveness.

This will enable us to gain a 32% share of the domestic

market and solidify our presence as a top player.

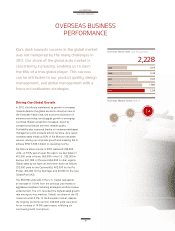

Strong Results despite Challenges

The domestic auto market was unable to shake off the

economic slowdown in 2012 despite the reduction of

the individual consumption tax. Of particular note, the

GDP growth rate hovered around 2.0%, its lowest level

since the 1999 Asian financial crisis, thereby restricting

consumption growth. As a result, demand for domestic

automobiles stood at a mere 481,000 units, down 2.2%

from the previous year.

In a bid to overcome this challenging business

environment, Kia Motors strived to expand its sales with

a focus on new cars including the K3 (Cerato/Forte) and

K9 (Kia Quoris), and flagship cars such as the Morning

(Picanto), Pride (Rio) and K5 (Optima). The K-series

range, consisting of K3, K5, K7 (Cadenza) and K9, covers

compact to large-size cars and has shown a consistent

upswing in sales. In particular, sales of K3 – a model that

has set a new standard for compact cars – reached 3,616

units within 9 days of its launch, confirming its status as a

raising star in the market. The K9, a premium luxury large-

size sedan launched last May, aggressively competed

against imported cars. The debut of the refreshed K7

with superior product quality in November also served to

strengthen Kia Motors’ premium brand image.