Honeywell 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

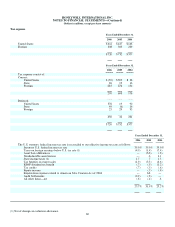

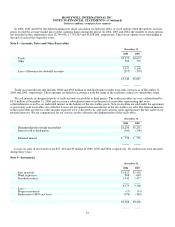

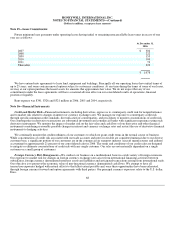

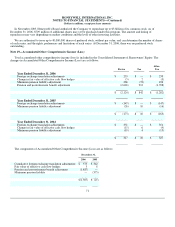

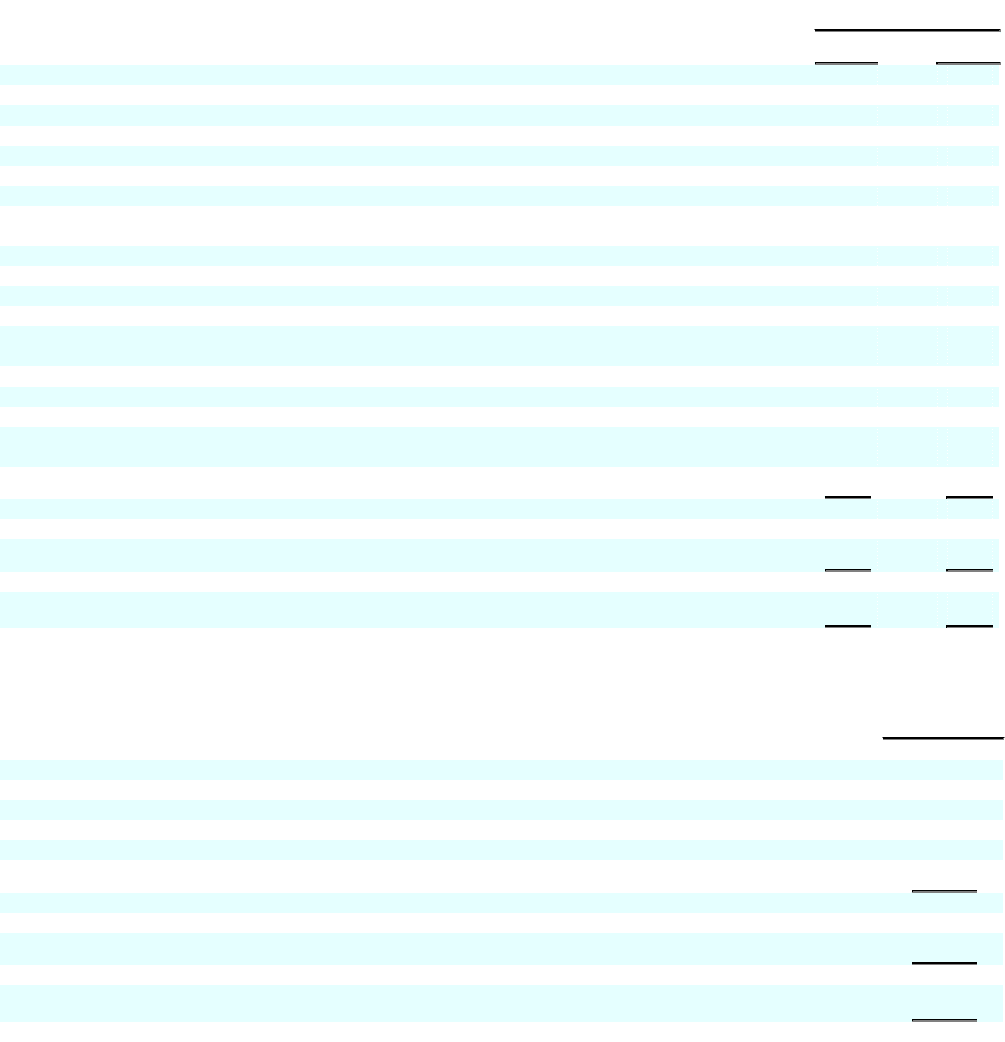

Note 14—Long-term Debt and Credit Agreements

December 31,

2006 2005

85⁄8% debentures due 2006 $ — $ 100

5.25% notes due 2006 — 336

51⁄8% notes due 2006 — 500

7.0% notes due 2007 350 350

71⁄8% notes due 2008 200 200

6.20% notes due 2008 200 200

Floating rate notes due 2009 300 —

Zero coupon bonds and money multiplier notes,

13.0%–14.26%, due 2009

100

100

Floating rate notes due 2009-2011 239 249

7.50% notes due 2010 1,000 1,000

61⁄8% notes due 2011 500 500

5.40% notes due 2016 400 —

Industrial development bond obligations, floating rate

maturing at various dates through 2037

65

65

65⁄8% debentures due 2028 216 216

9.065% debentures due 2033 51 51

5.70% notes due 2036 550 —

Other (including capitalized leases), 0.53%–16.40%,

maturing at various dates through 2016

161

210

4,332 4,077

Less—current portion (423) (995)

$3,909 $3,082

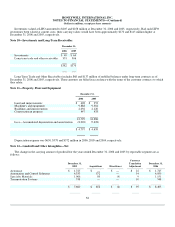

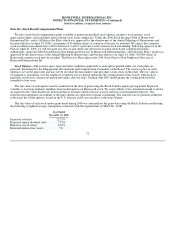

The schedule of principal payments on long-term debt is as follows:

At December 31,

2006

2007 $ 423

2008 416

2009 511

2010 1,130

2011 526

Thereafter 1,326

4,332

Less—current portion (423)

$ 3,909

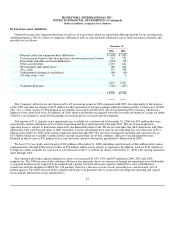

We maintain a $2.3 billion five year revolving credit facility with a group of banks, arranged by Citigroup Global Markets Inc. and

J.P.Morgan Securities Inc. This credit facility contains a $500 million sub-limit for the issuance of letters of credit. The $2.3 billion

credit facility is maintained for general corporate purposes, including support for the issuance of commercial paper. We had no

borrowings outstanding under the credit facility at December 31, 2006. We have issued $145 million of letters of credit under the

credit facility at December 31, 2006.

The credit agreement does not restrict our ability to pay dividends and contains no financial covenants. The failure to comply with

customary conditions or the occurrence of customary events of default contained in the credit agreement would prevent any further

borrowings and would generally

66