Honeywell 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

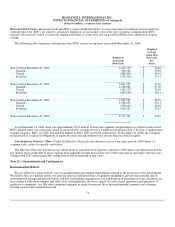

SFAS No. 5, “Accounting for Contingencies”. The estimate is based upon the disease criteria and payment values contained in the

NARCO Trust Distribution Procedures negotiated with the NARCO Asbestos Claimants Committee and the NARCO future claimants'

representative. Honeywell projected the probable number and value, including trust claim handling costs, of asbestos related future

liabilities based upon historical experience with similar trusts. The methodology used to estimate the liability for future claims has

been commonly accepted by numerous courts and is the same methodology that is utilized by an expert who is routinely retained by

the asbestos claimants committee in asbestos related bankruptcies. The valuation methodology includes an analysis of the population

likely to have been exposed to asbestos containing products, epidemiological studies to estimate the number of people likely to

develop asbestos related diseases, NARCO claims filing history, the pending inventory of NARCO asbestos related claims and

payment rates expected to be established by the NARCO trust. In December 2006, (as a result of significantly varying experiences of

asbestos claims filing rates in the tort system and in certain operating asbestos trusts) and the changing claims experience in those

forums (as a result of more clearly defined proof requirements and possible enactment of state medical criteria bills), we updated the

range of estimated liability for future NARCO-related claims. Such update resulted in a range of estimated liability for future claims

of $743 to $961 million. We believe that no amount within this range is a better estimate than any other amount. Accordingly, we

recorded the minimum amount in the range which resulted in a reduction of $207 million in our estimated liability for future NARCO-

related asbestos claims.

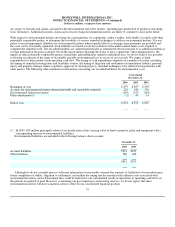

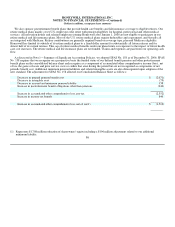

As of December 31, 2006 and 2005, our consolidated financial statements reflect an insurance receivable corresponding to the

liability for settlement of pending and future NARCO-related asbestos claims of $955 million and $1.1 billion, respectively. This

coverage reimburses Honeywell for portions of the costs incurred to settle NARCO related claims and court judgments as well as

defense costs and is provided by a large number of insurance policies written by dozens of insurance companies in both the domestic

insurance market and the London excess market. At December 31, 2006, a significant portion of this coverage is with insurance

companies with whom we have agreements to pay full policy limits based on corresponding Honeywell claims costs. We conduct

analyses to determine the amount of insurance that we estimate is probable of recovery in relation to payment of current and estimated

future claims. While the substantial majority of our insurance carriers are solvent, some of our individual carriers are insolvent, which

has been considered in our analysis of probable recoveries. We made judgments concerning insurance coverage that we believe are

reasonable and consistent with our historical dealings with our insurers, our knowledge of any pertinent solvency issues surrounding

insurers and various judicial determinations relevant to our insurance programs.

In the second quarter of 2006, Travelers Casualty and Insurance Company (“Travelers”) filed a lawsuit against Honeywell and

other insurance carriers in the Supreme Court of New York, County of New York, disputing obligations for NARCO-related asbestos

claims under high excess insurance coverage issued by Travelers and other insurance carriers. Approximately $370 million of

coverage under these policies is included in our NARCO-related insurance receivable at December 31, 2006. Honeywell believes it is

entitled to the coverage at issue and has filed counterclaims in the Superior Court of New Jersey seeking, among other things,

declaratory relief with respect to this coverage. Although Honeywell expects to prevail in this matter, an adverse outcome could have

a material impact on our results of operations in the period recognized but would not be material to our consolidated financial position

or operating cash flows.

Projecting future events is subject to many uncertainties that could cause the NARCO related asbestos liabilities or assets to be

higher or lower than those projected and recorded. There is no assurance that a plan of reorganization will be confirmed, that

insurance recoveries will be timely or whether there will be any NARCO related asbestos claims beyond 2018. Given the inherent

uncertainty in predicting future events, we review our estimates periodically, and update them based on

79