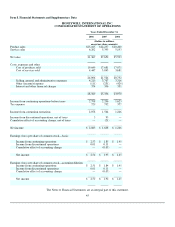

Honeywell 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Accountants. New accounting standards effective in 2006 which had a material impact on our consolidated financial statements are

described in the Recent Accounting Pronouncements section in Note 1 to the financial statements in “Item 8. Financial Statements and

Supplementary Data”.

Contingent Liabilities—We are subject to a number of lawsuits, investigations and claims (some of which involve substantial

dollar amounts) that arise out of the conduct of our global business operations or those of previously owned entities. These

contingencies relate to product liabilities (including asbestos), contractual matters, and environmental, health and safety matters. We

recognize a liability for any contingency that is probable of occurrence and reasonably estimable. We continually assess the likelihood

of any adverse judgments or outcomes to our contingencies, as well as potential amounts or ranges of probable losses, and recognize a

liability, if any, for these contingencies based on a careful analysis of each matter with the assistance of outside legal counsel and, if

applicable, other experts. Such analysis includes making judgments concerning matters such as the costs associated with

environmental matters, the outcome of negotiations, the number and cost of pending and future asbestos claims, and the impact of

evidentiary requirements. Because most contingencies are resolved over long periods of time, liabilities may change in the future due

to new developments (including new discovery of fact, changes in legislation and outcomes of similar cases through the judicial

system), changes in assumptions or changes in our settlement strategy. For a discussion of our contingencies related to environmental,

asbestos and other matters, including management's judgment applied in the recognition and measurement of specific liabilities, see

Notes 1 and 21 to the financial statements.

Asbestos Related Contingencies and Insurance Recoveries—We are a defendant in personal injury actions related to asbestos

containing products (refractory products and friction products). We recognize a liability for any asbestos related contingency that is

probable of occurrence and reasonably estimable. Regarding North American Refractories Company (NARCO) asbestos related

claims, we accrue for pending claims based on terms and conditions, including evidentiary requirements, in definitive agreements or

agreements in principle with current claimants. We have also accrued for the probable value of future NARCO asbestos related claims

through 2018 based on the disease criteria and payment values contained in the NARCO trust as described in Note 21 to the financial

statements. In light of the inherent uncertainties in making long term projections regarding claims filing rates and disease

manifestation, we do not believe that we have a reasonable basis for estimating NARCO asbestos claims beyond 2018 under

Statement of Financial Accounting Standards No. 5, “Accounting for Contingencies” (SFAS No. 5). Regarding Bendix asbestos

related claims, we accrue for the estimated value of pending claims based on expected claim resolution values and dismissal rates. In

the fourth quarter of 2006, the Company accrued a liability for the estimated cost of future anticipated claims related to Bendix

through 2011 based on our assessment of additional claims that may be brought against us and anticipated resolution values in the tort

system. In December 2006, we also changed our methodology for valuing Bendix pending and future claims from using average

resolution values of the previous five years to using average resolution values of the previous two years. For additional information

relating to Bendix related claims see Note 21 to the financial statements. We continually assess the likelihood of any adverse

judgments or outcomes to our contingencies, as well as potential ranges of probable losses and recognize a liability, if any, for these

contingencies based on an analysis of each individual issue with the assistance of outside legal counsel and, if applicable, other

experts.

In connection with recognition of liabilities for asbestos related matters, we record asbestos related insurance recoveries that are

deemed probable. In assessing the probability of insurance recovery, we make judgments concerning insurance coverage that we

believe are reasonable and consistent with our historical experience with our insurers, our knowledge of any pertinent solvency issues

surrounding insurers, various judicial determinations relevant to our insurance programs and our consideration of the impacts of any

settlements with our insurers. At December 31, 2006, we have recorded insurance receivables of $955 million that can be specifically

allocated to NARCO related asbestos liabilities. We also have $1.9 billion in coverage remaining for Bendix related asbestos liabilities

although there are gaps in our coverage due to insurance company insolvencies, certain uninsured periods and insurance settlements,

resulting in approximately 50 percent of these claims on a cumulative historical basis being reimbursable by insurance. Our insurance

is with both the domestic insurance market and the London excess market. While the substantial majority of our insurance carriers are

solvent, some of

40