Honeywell 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

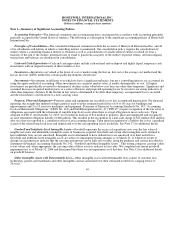

assets and liabilities are remeasured at year-end exchange rates. Remeasurement adjustments for these subsidiaries are included in

earnings.

Derivative Financial Instruments—As a result of our global operating and financing activities, we are exposed to market risks

from changes in interest and foreign currency exchange rates and commodity prices, which may adversely affect our operating results

and financial position. We minimize our risks from interest and foreign currency exchange rate and commodity price fluctuations

through our normal operating and financing activities and, when deemed appropriate through the use of derivative financial

instruments. Derivative financial instruments are used to manage risk and are not used for trading or other speculative purposes and

we do not use leveraged derivative financial instruments. Derivative financial instruments used for hedging purposes must be

designated and effective as a hedge of the identified risk exposure at the inception of the contract. Accordingly, changes in fair value

of the derivative contract must be highly correlated with changes in fair value of the underlying hedged item at inception of the hedge

and over the life of the hedge contract.

All derivatives are recorded on the balance sheet as assets or liabilities and measured at fair value. For derivatives designated as

hedges of the fair value of assets or liabilities, the changes in fair values of both the derivatives and the hedged items are recorded in

current earnings. For derivatives designated as cash flow hedges, the effective portion of the changes in fair value of the derivatives

are recorded in Accumulated Other Comprehensive Income (Loss) and subsequently recognized in earnings when the hedged items

impact earnings.

Transfers of Financial Instruments—Sales, transfers and securitization of financial instruments are accounted for under

Statement of Financial Accounting Standards No. 140, “Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities”. We sell interests in designated pools of trade accounts receivables to third parties. The receivables are

removed from the Consolidated Balance Sheet at the time they are sold. The value assigned to our subordinated interests and

undivided interests retained in trade receivables sold is based on the relative fair values of the interests retained and sold. The carrying

value of the retained interests approximates fair value due to the short-term nature of the collection period for the receivables.

Income Taxes—Deferred tax liabilities or assets reflect temporary differences between amounts of assets and liabilities for

financial and tax reporting. Such amounts are adjusted, as appropriate, to reflect changes in tax rates expected to be in effect when the

temporary differences reverse. A valuation allowance is established to offset any deferred tax assets if, based upon the available

evidence, it is more likely than not that some or all of the deferred tax assets will not be realized. The determination of the amount of a

valuation allowance to be provided on recorded deferred tax assets involves estimates regarding (1) the timing and amount of the

reversal of taxable temporary differences, (2) expected future taxable income, and (3) the impact of tax planning strategies. In

assessing the need for a valuation allowance, we consider all available positive and negative evidence, including past operating results,

projections of future taxable income and the feasibility of ongoing tax planning strategies. The projections of future taxable income

include a number of estimates and assumptions regarding our volume, pricing and costs. Additionally, valuation allowances related to

deferred tax assets can be impacted by changes to tax laws.

Significant judgment is required in determining income tax provisions under Statement of Financial Accounting Standards

No. 109 “Accounting for Income Taxes” (SFAS No. 109) and in evaluating tax positions. We establish additional provisions for

income taxes when, despite the belief that tax positions are fully supportable, there remain certain positions that are likely to be

challenged and that may not be sustained on review by tax authorities. In the normal course of business, the Company and its

subsidiaries are examined by various Federal, State and foreign tax authorities. We regularly assess the potential outcomes of these

examinations and any future examinations for the current or prior years in determining the adequacy of our provision for income

taxes. We continually assess the likelihood

53