Honeywell 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

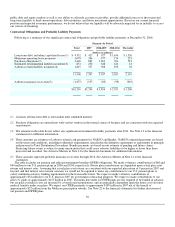

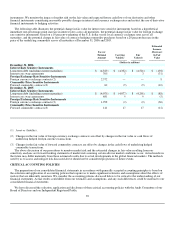

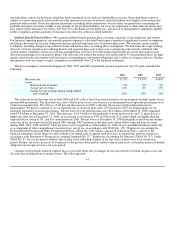

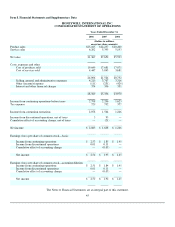

highlights the sensitivity of our U.S. pension obligations and expense to changes in these assumptions, assuming all other assumptions

remain constant:

Change in Assumption

Impact on Annual

Pension Expense Impact on PBO

0.25 percentage point decrease in discount rate Increase $50 million Increase $345 million

0.25 percentage point increase in discount rate Decrease $50 million Decrease $330 million

0.25 percentage point decrease in expected rate of return on assets Increase $30 million —

0.25 percentage point increase in expected rate of return on assets Decrease $30 million —

Net periodic pension expense for our pension plans is expected to be approximately $200 million in 2007, a $113 million decrease

from 2006 due principally to a decrease in the amortization of net losses. The decline in the amortization of net losses results

principally from an increase in the discount rate at December 31, 2006 and actual plan asset returns higher than the expected rate of

return in 2004 and 2006.

In 2006, 2005 and 2004 we were not required to make a contribution to satisfy minimum statutory funding requirements in our

U.S. pension plans. We made voluntary contributions of $68 and $40 million to our U.S. pension plans in 2006 and 2004, respectively,

mainly for government contracting purposes. Future plan contributions are dependent upon actual plan asset returns and interest rates.

Assuming that actual plan returns are consistent with our expected plan return of 9 percent in 2007 and beyond, and that interest rates

remain constant, we would not be required to make any contributions to our U.S. pension plans to satisfy minimum statutory funding

requirements for the foreseeable future. However, we expect to make voluntary contributions of approximately $52 million in cash in

2007 to certain of our U.S. pension plans for government contracting purposes. We also expect to contribute approximately $155

million in cash in 2007 to our non-U.S. defined benefit pension plans to satisfy regulatory funding standards.

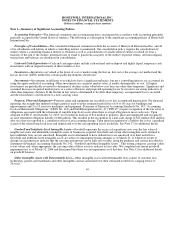

Long-Lived Assets (including Tangible and Definite-Lived Intangible Assets)—To conduct our global business operations and

execute our business strategy, we acquire tangible and intangible assets, including property, plant and equipment and definite-lived

intangible assets. At December 31, 2006, the net carrying amount of these long-lived assets totaled $5.9 billion. The determination of

useful lives (for depreciation/amortization purposes) and whether or not these assets are impaired involves the use of accounting

estimates and assumptions, changes in which could materially impact our financial condition or operating performance if actual results

differ from such estimates and assumptions. We periodically evaluate the recoverability of the carrying amount of our long-lived

assets whenever events or changes in circumstances indicate that the carrying amount of a long-lived asset group may not be fully

recoverable. The principal factors we consider in deciding when to perform an impairment review are as follows:

• significant under-performance (i.e., declines in sales, earnings or cash flows) of a business or product line in relation to

expectations;

• annual operating plans or five-year strategic plans that indicate an unfavorable trend in operating performance of a business

or product line;

• significant negative industry or economic trends; and

• significant changes or planned changes in our use of the assets.

Once it is determined that an impairment review is necessary, recoverability of assets is measured by comparing the carrying

amount of the asset grouping to the estimated future undiscounted cash flows. If the carrying amount exceeds the estimated future

undiscounted cash flows, the asset grouping is considered to be impaired. The impairment is then measured as the difference between

the carrying amount of the asset grouping and its fair value. We use the best information available to determine fair value, which are

usually either market prices (if available) or an estimate of the future discounted cash flow. The key estimates in our discounted cash

flow analysis include expected industry growth rates, our assumptions as to volume, selling prices and costs, and the discount rate

selected. As described in more detail in the repositioning and other charges section of our MD&A, we have recorded impairment

charges related to long-lived assets of $12 and $23 million in 2006 and 2005, respectively, principally related to businesses in our

Specialty Materials reportable segment. These businesses were

42