Honeywell 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

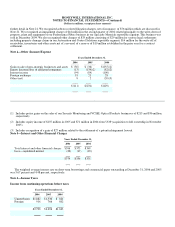

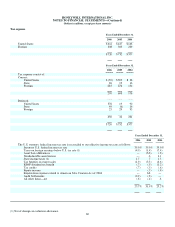

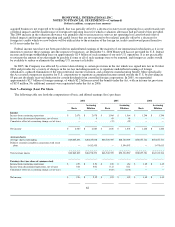

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

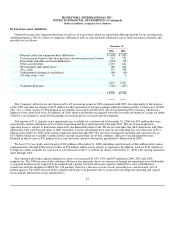

In November 2005, the Company acquired the remaining 50 percent of UOP LLC giving Honeywell full ownership of the entity.

The aggregate value of the purchase price was approximately $825 million, including the assumption of approximately $115 million

of outstanding debt. The purchase price for the acquisition was allocated to the tangible and identifiable intangible assets acquired and

liabilities assumed based on their estimated fair values at the acquisition date. The Company has assigned $339 million to identifiable

intangible assets, predominantly existing technology, which is being amortized over 15 years on a straight-line basis and trade names,

which are not amortized. The excess of the purchase price over the estimated fair values of net assets acquired approximating $336

million, was recorded as goodwill. This goodwill is non-deductible for tax purposes. Following this acquisition, which is being

accounted for by the purchase method, results of operations have been included into the Specialty Materials segment. Prior to that

date, UOP results for the 50 percent share that the Company owned was included in equity income of affiliated companies.

On March 31, 2005, the Company purchased 100% of the issued and ordinary preference share capital of NOVAR plc (NOVAR)

for $1.7 billion, net of cash acquired, which represented $2.4 billion for consideration of all outstanding shares and outstanding

options to be exercised, net of the assumption of debt of $0.7 billion. Transaction costs related to this acquisition were $49 million. In

December 2005, we completed the sale of the Security Printing business to M&F Worldwide Corp. for $800 million in cash. In

February 2006, we completed the sale of Indalex to an affiliate of private investment firm Sun Capital Partners, Inc. for approximately

$425 million in cash. The Indalex business was classified as held for sale in our December 31, 2005 Consolidated Balance Sheet and

both the Indalex and Security Printing businesses have been presented as discontinued operations in our Statement of Operations for

all periods presented. Goodwill of approximately $1.3 billion was recognized and we allocated $261 million to other intangible assets

(contractual customer relationships, existing technology and trademarks). These intangible assets are being amortized over their

estimated useful lives which range from 5 to 15 years using straight-line and accelerated amortization methods. In addition, accrued

liabilities included $76 million of restructuring costs related to the integration of the NOVAR operations.

As of December 31, 2006, the purchase accounting for both First Technology and Gardiner Groupe is still subject to final

adjustment primarily for amounts related to the businesses that were sold and pre-acquisition contingencies.

In connection with all acquisitions in 2006, 2005 and 2004, except for the First Technology and NOVAR acquisitions as described

above, the amounts recorded for transaction costs and the costs of integrating the acquired businesses into Honeywell were not

material. The results of operations of all acquired businesses have been included in the consolidated results of Honeywell from their

respective acquisition dates.

The pro forma results for 2006, 2005 and 2004, assuming these acquisitions had been made at the beginning of the year, would not

be materially different from consolidated reported results.

56