Honeywell 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

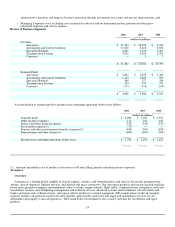

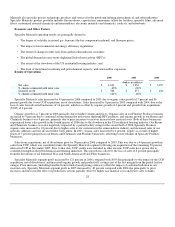

largely due to higher prices, offset by the impact of our exit in late 2005 from the North American Friction Materials OE business.

Transportation Systems segment profit increased by 3 percent in 2006 compared with 2005 due primarily to increased Turbo

Technologies volume and productivity savings including the benefits of prior year restructuring actions, which offset higher material

and labor inflation and increased warranty expense. Transportation Systems segment profit in 2005 decreased by 3 percent compared

with 2004 due primarily to the impact of higher raw material costs (mainly steel and nickel) and operating costs associated with the

exit from North American Friction Materials OE business in late 2005, partially offset by the effects of higher prices and productivity

actions.

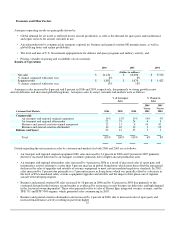

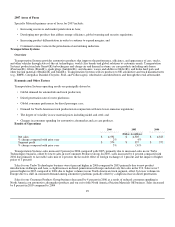

2007 Areas of Focus

Transportation Systems primary areas of focus in 2007 include:

• Sustaining superior turbocharger technology;

• Increasing global market penetration and share of diesel and gasoline turbocharger OEM demand; and

• Expanding and strengthening established strong product brands in our Consumer Products Group business, including

expansion into new geographic and demographic segments.

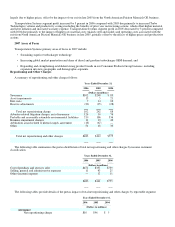

Repositioning and Other Charges

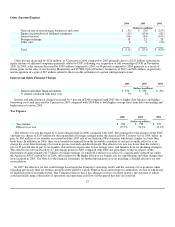

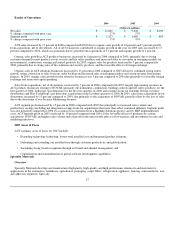

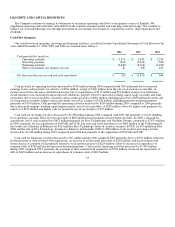

A summary of repositioning and other charges follows:

Years Ended December 31,

2006 2005 2004

(Dollars in millions)

Severance $102 $248 $ 85

Asset impairments 15 5 21

Exit costs 7 14 10

Reserve adjustments (22) (25) (28)

Total net repositioning charge 102 242 88

Asbestos related litigation charges, net of insurance 126 10 76

Probable and reasonably estimable environmental liabilities 210 186 536

Business impairment charges 12 23 42

Arbitration award related to phenol supply agreement (18) (67) —

Other 51 18 33

Total net repositioning and other charges $483 $412 $775

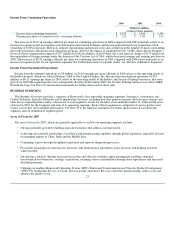

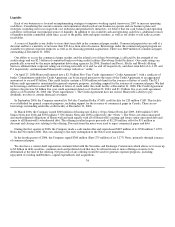

The following table summarizes the pretax distribution of total net repositioning and other charges by income statement

classification.

Years Ended December 31,

2006 2005 2004

(Dollars in millions)

Cost of products and services sold $472 $357 $739

Selling, general and administrative expenses 11 43 25

Other (income) expense — 12 11

$483 $412 $775

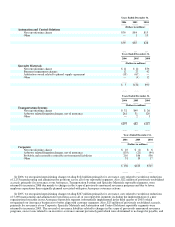

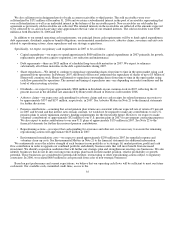

The following tables provide details of the pretax impact of total net repositioning and other charges by reportable segment.

Years Ended December 31,

2006 2005 2004

(Dollars in millions)

Aerospace

Net repositioning charge $10 $96 $ 5