Honeywell 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

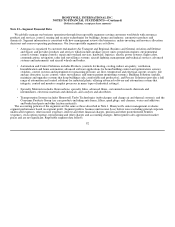

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

Pension

Benefits

Other

Postretirement

Benefits

2006 2006

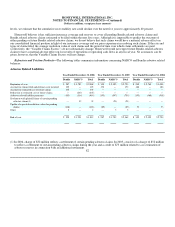

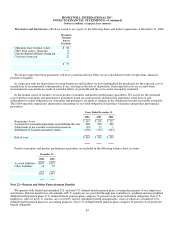

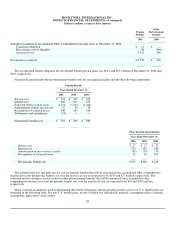

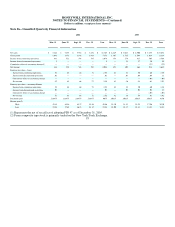

Amounts recognized in Accumulated Other Comprehensive Income (loss) at December 31, 2006

Transition obligation $ 11 $ —

Prior service cost or (benefit) 98 (146)

Actuarial losses 2,423 486

Net amount recognized $ 2,532 $ 340

The accumulated benefit obligation for our defined benefit pension plans was $16.2 and $15.4 billion at December 31, 2006 and

2005, respectively.

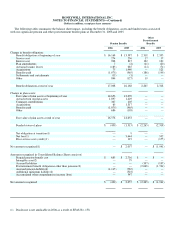

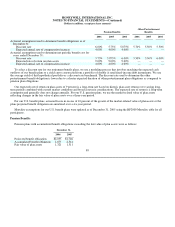

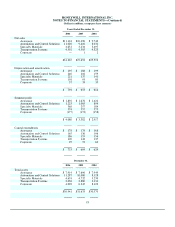

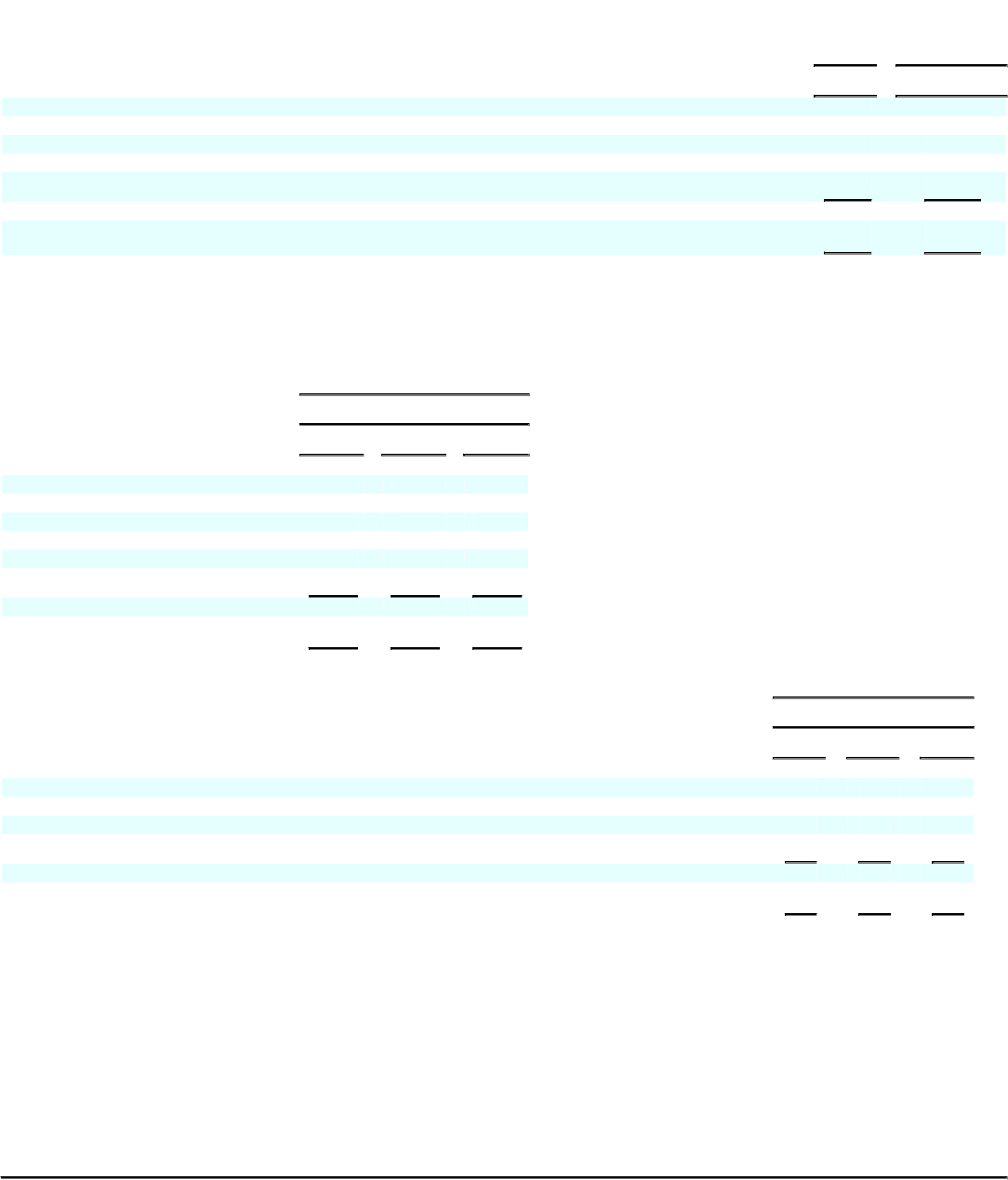

Net periodic pension and other postretirement benefit costs for our significant plans include the following components:

Pension Benefits

Years Ended December 31,

2006 2005 2004

Service cost $ 274 $ 236 $ 222

Interest cost 908 815 755

Expected return on plan assets (1,251) (1,104) (1,042)

Amortization of prior service cost 27 30 38

Recognition of actuarial losses 348 392 413

Settlements and curtailments (13) — —

Net periodic benefit cost $ 293 $ 369 $ 386

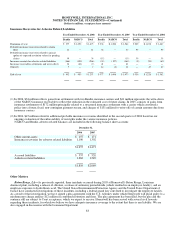

Other Postretirement Benefits

Years Ended December 31,

2006 2005 2004

Service cost $ 17 $ 17 $ 17

Interest cost 122 120 138

Amortization of prior service (credit) (40) (39) (37)

Recognition of actuarial losses 52 63 101

Net periodic benefit cost $ 151 $ 161 $ 219

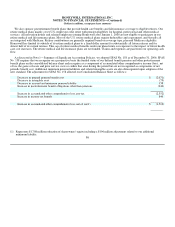

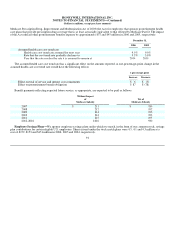

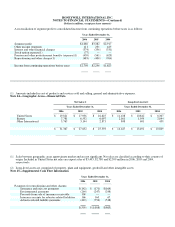

The estimated net loss and prior service cost for pension benefits that will be amortized from accumulated other comprehensive

income (loss) into net periodic benefit cost over the next fiscal year are expected to be $193 and $27 million, respectively. The

estimated net loss and prior service credit for other postretirement benefits that will be amortized from accumulated other

comprehensive income (loss) into net periodic benefit cost over the next fiscal year are expected to be $45 and $(40) million,

respectively.

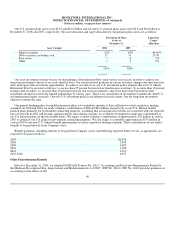

Major actuarial assumptions used in determining the benefit obligations and net periodic benefit cost for our U.S. benefit plans are

presented in the following table. For non-U.S. benefit plans, no one of which was individually material, assumptions reflect economic

assumptions applicable to each country.

88