Honeywell 2006 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

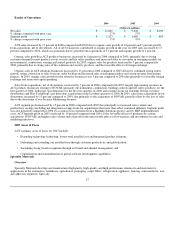

reportable segments. Also, $28 million of previously established accruals, primarily for severance, were returned to income in 2004,

due to fewer employee separations than originally planned associated with certain prior repositioning actions, resulting in reduced

severance liabilities principally in our Automation and Control Solutions reportable segment.

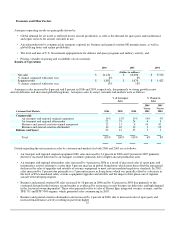

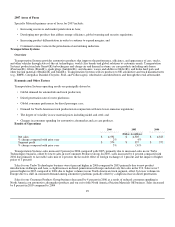

Our 2006 repositioning actions are expected to generate incremental pretax savings of approximately $100 million in 2007 compared

with 2006 principally from planned workforce reductions. Cash expenditures for severance and other exit costs necessary to execute

our repositioning actions were $142, $171 and $164 million in 2006, 2005 and 2004, respectively. Such expenditures for severance

and other exit costs have been funded principally through operating cash flows. Cash expenditures for severance and other exit costs

necessary to execute the remaining actions will approximate $125 million in 2007 and will be funded through operating cash flows.

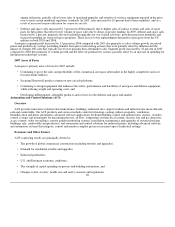

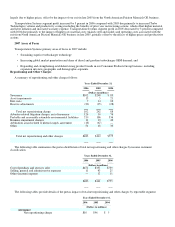

In 2006, we recognized a charge of $210 million for environmental liabilities deemed probable and reasonably estimable during

the year. We recognized asbestos related litigation charges, net of insurance, of $126 million which are discussed in more detail in

Note 21 to the financial statements. We recognized other charges of $51 million related to our Corporate segment primarily for the

settlement of a property damage claim litigation matter in Brunswick, GA and our entrance into a plea agreement related to an

environmental matter at our Baton Rouge, LA. facility (see Note 21 to the financial statements). We recognized impairment charges of

$12 million related to the write-down of property, plant and equipment held for sale in Specialty Materials. We also recognized a

credit of $18 million in connection with an arbitration award for overcharges by a supplier of phenol to Specialty Materials for 2005

transactions.

In 2005, we recognized a charge of $186 million for environmental liabilities deemed probable and reasonably estimable during

the year. We recognized asbestos related litigation charges, net of insurance, of $10 million which are discussed in more detail in

Note 21 to the financial statements. We recognized a credit of $67 million in connection with an arbitration award for overcharges by

a supplier of phenol to our Specialty Materials business from June 2003 through the end of 2004. We recognized impairment charges

of $23 million related to the write-down of property, plant and equipment held and used in our Specialty Materials reportable segment.

We also recognized other charges of $18 million principally related to the modification of a lease agreement for the Corporate

headquarters facility ($10 million) and for various legal settlements ($7 million).

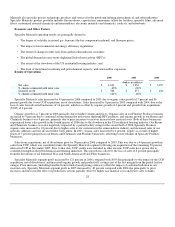

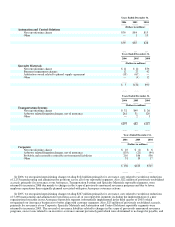

In 2004, we recognized a charge of $536 million for probable and reasonably estimable environmental liabilities primarily related

to the estimated costs of the court-ordered excavation and transport for offsite disposal of approximately one million tons of chromium

residue present at a predecessor Honeywell site located in Jersey City, New Jersey, and environmental conditions in and around

Onondaga Lake in Syracuse, New York. Both of these environmental matters are discussed in further detail in Note 21 to the financial

statements. We recognized asbestos related litigation charges, net of insurance, of $76 million which are discussed in Note 21. We

recognized an impairment charge of $42 million in the second quarter of 2004 related principally to the write-down of property, plant

and equipment of our Performance Fibers business in our Specialty Materials reportable segment. This business was sold in December

2004. We also recognized other charges of $33 million consisting of $29 million for various legal settlements including property

damage claims in our Automation and Control Solutions reportable segment, $14 million for the write-off of receivables, inventories

and other assets net of a reversal of a reserve of $10 million established in the prior year for a contract settlement.

32