Honeywell 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

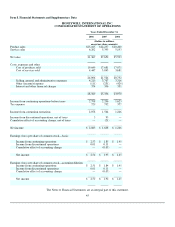

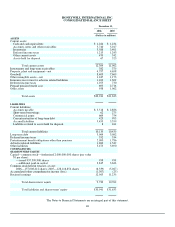

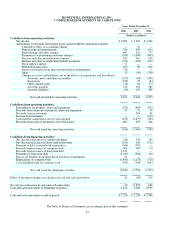

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

quarter of 2006, the Company accrued a liability for the estimated cost of future anticipated claims related to Bendix through 2011

based on our assessment of additional claims that may be brought against us and anticipated resolution values in the tort system. In

December 2006, we also changed our methodology for valuing Bendix pending and future claims from using average resolution

values of the previous five years to using average resolution values of the previous two years. For additional information see Note 21.

We continually assess the likelihood of any adverse judgments or outcomes to our contingencies, as well as potential ranges of

probable losses and recognize a liability, if any, for these contingencies based on an analysis of each individual issue with the

assistance of outside legal counsel and, if applicable, other experts.

In connection with the recognition of liabilities for asbestos related matters, we record asbestos related insurance recoveries that

are deemed probable. In assessing the probability of insurance recovery, we make judgments concerning insurance coverage that we

believe are reasonable and consistent with our historical experience with our insurers, our knowledge of any pertinent solvency issues

surrounding insurers, various judicial determinations relevant to our insurance programs and our consideration of the impacts of any

settlements with our insurers.

Aerospace Sales Incentives—The Company provides sales incentives to commercial aircraft manufacturers and airlines in

connection with their selection of our aircraft wheel and braking system hardware and auxiliary power units for installation on

commercial aircraft. These incentives principally consist of free or deeply discounted products but also include credits for future

purchases of product and upfront cash payments. These costs are expensed as provided. For aircraft manufacturers, incentives are

recorded when the products are delivered; for airlines, incentives are recorded when the associated aircraft are delivered by the aircraft

manufacturer to the airline.

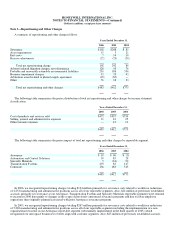

Research and Development—Research and development costs for company-sponsored research and development projects are

expensed as incurred. Such costs are principally included in Cost of Products Sold and were $1,411, $1,072 and $917 million in 2006,

2005 and 2004, respectively.

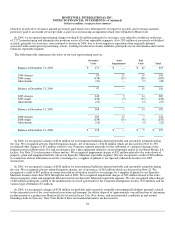

Stock-Based Compensation Plans—Effective January 1, 2006, we adopted SFAS No. 123 (revised 2004), “Share-Based

Payment” (SFAS No. 123R) requiring that compensation cost relating to share-based payment awards made to employees and

directors be recognized in the financial statements. The principal awards issued under our stock-based compensation plans, which are

described in Note 20, “Stock-Based Compensation Plans” include non-qualified stock options and restricted stock units (RSUs). The

cost for such awards is measured at the grant date based on the calculated fair value of the award. The value of the portion of the

award that is ultimately expected to vest is recognized as expense over the requisite service periods (generally the vesting period of the

equity award) in our Consolidated Statement of Operations.

Prior to January 1, 2006, we accounted for share-based compensation cost using the intrinsic value method in accordance with

Accounting Principles Board No. 25, “Accounting for Stock Issued to Employees” (APB No. 25), and related interpretations. We also

followed disclosure requirements of SFAS No. 123, “Accounting for Stock-Based Compensation”, as amended by SFAS No. 148,

“Accounting for Stock-Based Compensation-Transition and Disclosure”. Under APB No. 25 there was no compensation cost

recognized in our Consolidated Statement of Operations for our stock option awards. Compensation cost for RSUs is recognized in

our Consolidated Statement of Operations and is included in selling, general and administrative expenses, and was not affected by our

adoption of FAS No. 123R.

We adopted SFAS No. 123R using the modified prospective method and, accordingly, the Consolidated Statement of Operations

for prior years has not been restated to reflect the fair value method of recognizing compensation cost relating to stock options. Share-

based compensation cost relating to stock options recognized in 2006 is based on the value of the portion of the award that is

ultimately expected to vest. SFAS No. 123R requires forfeitures to be estimated at the time of grant in

51