Honeywell 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

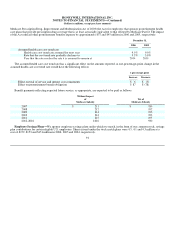

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

of Environmental Quality (LADEQ) to resolve alleged civil environmental violations at our Baton Rouge and Geismar, Louisiana

facilities that, in part, overlap with the subject of the federal investigation.

Brunswick, GA—Honeywell has reached settlements with Glynn County, Georgia and with a group of private individuals who

own or owned properties near the Allied Chemical (a predecessor company) chlor-alkali plant, in Brunswick, Georgia in various

related cases. The plaintiffs had alleged that mercury and PCB discharges from the plant devalued their property, and caused them loss

of use and enjoyment of that property. They were seeking compensatory, injunctive and punitive damages. The settlement with Glynn

County was for $25 million and that amount has been paid. The settlement with the private property owners was also for $25 million

and the money has been placed into the plaintiffs' attorney trust account pending confirmation that none of the private landowners

have opted out of the settlement and allocation of the proceeds among the parties by a special master appointed by the court.

Honeywell and the private landowners will ask the court to confirm the settlement as final in a hearing set for April 6, 2007.

Allen, et, al. v. Honeywell Retirement Earnings Plan—This represents a class action lawsuit in which plaintiffs seek unspecified

damages relating to allegations that, among other things, Honeywell impermissibly reduced the pension benefits of employees of

Garrett Corporation (a predecessor entity) when the plan was amended in 1983 and failed to calculate certain benefits in accordance

with the terms of the plan. In the third quarter of 2005, the U.S. District Court for the District of Arizona ruled in favor of the plaintiffs

on these claims and in favor of Honeywell on virtually all other claims. We strongly disagree with, and intend to appeal, the Court's

adverse ruling. A class was certified by the Court in September 2006. In light of the merits of our arguments on appeal and our

substantial affirmative defenses which have not yet been considered by the Court, we continue to expect to prevail in this matter.

Accordingly, we do not believe that a liability is probable of occurrence and reasonably estimable and have not recorded a provision

for this matter in our financial statements. Given the uncertainty inherent in litigation and the wide range of potential remedies, it is

not possible to estimate the range of possible loss that might result from an adverse resolution of this matter. Although we expect to

prevail in this matter, an adverse outcome could have a material adverse effect on our results of operations or operating cash flows in

the periods recognized or paid. We do not believe that an adverse outcome in this matter would have a material adverse effect on our

consolidated financial position.

We are subject to a number of other lawsuits, investigations and disputes (some of which involve substantial amounts claimed)

arising out of the conduct of our business, including matters relating to commercial transactions, government contracts, product

liability, prior acquisitions and divestitures, employee benefit plans, and health and safety matters. We recognize a liability for any

contingency that is probable of occurrence and reasonably estimable. We continually assess the likelihood of adverse judgments of

outcomes in these matters, as well as potential ranges of probable losses (taking into consideration any insurance recoveries), based on

a careful analysis of each matter with the assistance of outside legal counsel and, if applicable, other experts.

Given the uncertainty inherent in litigation, we do not believe it is possible to develop estimates of the range of reasonably

possible loss in excess of current accruals for these matters. Considering our past experience and existing accruals, we do not expect

the outcome of these matters, either individually or in the aggregate, to have a material adverse effect on our consolidated financial

position. Because most contingencies are resolved over long periods of time, potential liabilities are subject to change due to new

developments, changes in settlement strategy or the impact of evidentiary requirements, which could cause us to pay damage awards

or settlements (or become subject to equitable remedies) that could have a material adverse effect on our results of operations or

operating cash flows in the periods recognized or paid.

84