Honeywell 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

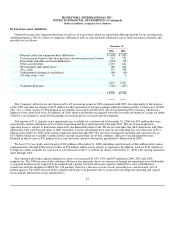

the accounting for planned major maintenance activities; specifically it precludes the use of the previously acceptable “accrue in

advance” method. FSP AUG AIR-1 is effective for fiscal years beginning after December 15, 2006. The implementation of this

standard will not have a material impact on our consolidated financial position or results of operations.

In September 2006, the SEC staff issued Staff Accounting Bulletin (“SAB”) 108 “Considering the Effects of Prior Year

Misstatements when Quantifying Misstatements in Current Year Financial Statements” (SAB 108). SAB 108 requires that public

companies utilize a “dual-approach” to assessing the quantitative effects of financial misstatements. This dual approach includes both

an income statement focused assessment and a balance sheet focused assessment. The guidance in SAB 108 must be applied to annual

financial statements for fiscal years ending after November 15, 2006. The adoption of SAB 108 did not have a material effect on our

consolidated financial position or results of operations.

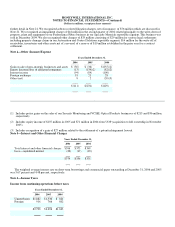

Note 2—Acquisitions and Divestitures

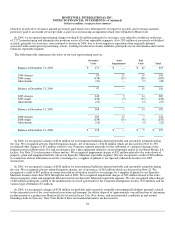

We acquired businesses for an aggregate cost of $979, $3,500 and $396 million in 2006, 2005 and 2004, respectively. All of our

acquisitions were accounted for under the purchase method of accounting, and accordingly, the assets and liabilities of the acquired

businesses were recorded at their estimated fair values at the dates of acquisition. Significant acquisitions made in these years are

discussed below.

In May 2006, the Company purchased Gardiner Groupe, a privately held company. The purchase price for the acquisition was

allocated to the tangible and identifiable intangible assets acquired and liabilities assumed based on their estimated fair values and

lives at the acquisition date. The Company has assigned $47 million to identifiable intangible assets, predominantly customer

relationships and trademarks. These intangible assets are being amortized over their estimated lives which range from 3 to 15 years

using straight-line and accelerated amortization periods. The excess of the purchase price over the estimated fair values of net assets

acquired approximating $129 million, was recorded as goodwill. This goodwill is non-deductible for tax purposes. This acquisition

was accounted for by the purchase method, and, accordingly, results of operations are included in the consolidated financial

statements from the date of acquisition. The results from the acquisition date through December 31, 2006 are included in the

Automation and Control Solutions segment and were not material to the consolidated financial statements.

In March 2006, the Company purchased First Technology plc, a U.K publicly listed company. The aggregate value of the purchase

price was $723 million, including the assumption of approximately $217 million of outstanding debt and $23 million of transaction

costs. The purchase price for the acquisition was allocated to the tangible and identifiable intangible assets acquired and liabilities

assumed based on their estimated fair values at the acquisition date. The Company has assigned $155 million to identifiable intangible

assets, predominantly customer relationships, existing technology and trademarks. These intangible assets are being amortized over

their estimated lives which range from 3 to 15 years using straight-line and accelerated amortization periods. The excess of the

purchase price over the estimated fair values of net assets acquired approximating $439 million, was recorded as goodwill. This

goodwill is non-deductible for tax purposes. This acquisition was accounted for by the purchase method, and, accordingly, results of

operations are included in the consolidated financial statements from the date of acquisition. The results from the acquisition date

through December 31, 2006 are included in the Automation and Control Solutions segment and were not material to the consolidated

financial statements. During the year the Company completed the sales of the First Technology Safety & Analysis business for $93

million and First Technology Automotive for $90 million which were accounted for as part of the purchase price allocation.

55