Honeywell 2006 Annual Report Download - page 170

Download and view the complete annual report

Please find page 170 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

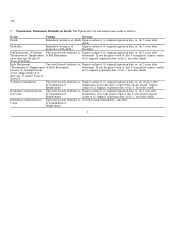

any year or fraction of a year, the greater of $150,000 or the dollar amount of any higher maximum limitation on annual compensation

taken into account under a qualified plan for such year or fraction of a year determined by the Secretary of Treasury or his delegate or

by law under section 401 (a) (17) of the Code; it being understood that annual compensation for purposes of such limitation is

computed differently from "earnings" for purposes of the plan. A participant's accrued benefits under the plan shall be referred to

hereinafter as the participant's "supplemental retirement benefits."

2.3 Earnings. For purposes of the plan, a participant's "earnings" for any year or fraction means his total, regular cash compensation

paid for such year or fraction for services rendered to the Pittway Companies (as such term is defined in the retirement plan) during

such year or fraction, consisting solely of his salary and his annual discretionary cash bonus, if any, for such year. It is expressly

understood that a participant's "earnings" do not include any other compensation, including, without limitation, any of the following:

(a) Long-tem incentive compensation;

(b) Unused vacation pay;

(c) Special cash bonuses;

(d) Any income realized for Federal income tax purposes as a result of the grant or exercise of an option or options to acquire shares

of stock of a Pittway Company, the receipt or exercise of any stock appreciation right or payment, or the disposition of shares

acquired by the exercise of such and option or right;

(e) Any noncash compensation, including any amounts contributed by the participant's employer(s) for his benefit under the

retirement plan or any other retirement or benefit plan, arrangement, or policy maintained by his employer(s);

(f) Any reimbursements for medical, dental or travel expenses, automobile allowances, relocation allowances, educational

assistance allowances, awards and other special allowances;

(g) Any income realized for Federal income tax purposes as a result of (i) group life insurance, (ii) the personal use of an employer-

owned automobile, or (iii) the transfer of restricted shares of stock or restricted property of a Pittway Company, or the removal

of any such restrictions;

(h) Any severance pay paid as a result of the participant's termination of employment (it being expressly understood that any

amount(s) taken into account pursuant to the final sentence of section 2.8 below shall not be deemed severance pay for purposes

hereof); or

(i) Any compensation paid or payable to the participant, or to any governmental body or agency on account of the participant,

under the terms of any state, Federal or foreign law requiring the payment of such compensation because of the participant's

voluntary or involuntary termination of employment with any Pittway Company.

2