Honeywell 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

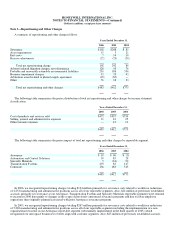

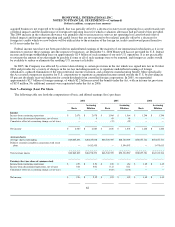

In 2006, 2005 and 2004, the diluted earnings per share calculation excludes the effect of stock options when the options' exercise

prices exceed the average market price of the common shares during the period. In 2006, 2005 and 2004, the number of stock options

not included in the computation were 22,749,056, 17,793,385 and 41,656,606, respectively. These stock options were outstanding at

the end of each of the respective years.

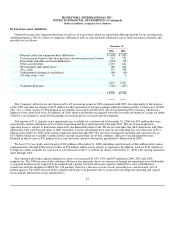

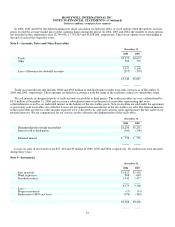

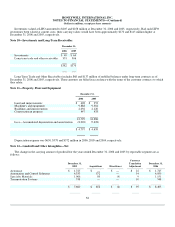

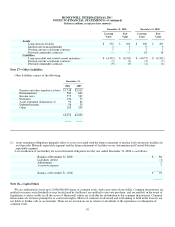

Note 8—Accounts, Notes and Other Receivables

December 31,

2006 2005

Trade $5,373 $4,623

Other 584 573

5,957 5,196

Less—Allowance for doubtful accounts (217) (179)

$5,740 $5,017

Trade Accounts Receivable includes $808 and $565 million of unbilled balances under long-term contracts as of December 31,

2006 and 2005, respectively. These amounts are billed in accordance with the terms of the customer contracts to which they relate.

We sell interests in designated pools of trade accounts receivables to third parties. The sold receivables are over-collateralized by

$171 million at December 31, 2006 and we retain a subordinated interest in the pool of receivables representing that over-

collateralization as well as an undivided interest in the balance of the receivables pools. New receivables are sold under the agreement

as previously sold receivables are collected. Losses are recognized when our interest in the receivables are sold. The retained interests

in the receivables are shown at the amounts expected to be collected by us, and such carrying value approximates the fair value of our

retained interests. We are compensated for our services in the collection and administration of the receivables.

December 31,

2006 2005

Designated pools of trade receivables $1,250 $1,251

Interest sold to third parties (500) (500)

Retained interest $ 750 $ 751

Losses on sales of receivables were $27, $18 and $9 million in 2006, 2005 and 2004, respectively. No credit losses were incurred

during those years.

Note 9—Inventories

December 31,

2006 2005

Raw materials $1,625 $1,438

Work in process 808 695

Finished products 1,342 1,427

3,775 3,560

Less—

Progress payments (17) (14)

Reduction to LIFO cost basis (170) (145)

$3,588 $3,401

63