Honeywell 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

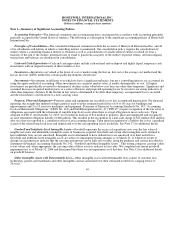

and amount of potential adjustments and adjust the income tax provision, the current tax liability and deferred taxes in the period in

which the facts that give rise to a revision become known.

Earnings Per Share—Basic earnings per share is based on the weighted average number of common shares outstanding. Diluted

earnings per share is based on the weighted average number of common shares outstanding and all dilutive potential common shares

outstanding.

Use of Estimates—The preparation of consolidated financial statements in conformity with generally accepted accounting

principles requires management to make estimates and assumptions that affect the reported amounts in the financial statements and

related disclosures in the accompanying notes. Actual results could differ from those estimates. Estimates and assumptions are

periodically reviewed and the effects of revisions are reflected in the consolidated financial statements in the period they are

determined to be necessary.

Reclassifications—Certain prior year amounts have been reclassified to conform to the current year presentation.

Recent Accounting Pronouncements—In June 2006, the FASB issued FASB Interpretation (“FIN”) No. 48 “Accounting for

Uncertainty in Income Taxes—an interpretation of FASB Statement 109”. FIN 48 establishes a single model to address accounting for

uncertainty in tax positions. FIN 48 clarifies the accounting for income taxes by prescribing a minimum recognition threshold a tax

position is required to meet before being recognized in the financial statements. FIN 48 also provides guidance on derecognition,

measurement, classification, interest and penalties, accounting in interim periods, disclosure and transition. FIN 48 is effective for

fiscal years beginning after December 15, 2006. Honeywell will adopt FIN 48 as of January 1, 2007 as required. Based on our current

assessment, and subject to any changes that may result from additional technical guidance being issued, the adoption of FIN 48 is

expected to reduce our existing reserves for uncertain tax positions by approximately $130 million, to be recorded as a cumulative

effect adjustment to equity, largely relating to state income tax matters.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (SFAS No. 157). SFAS No. 157 establishes a

common definition for fair value to be applied to US GAAP requiring use of fair value, establishes a framework for measuring fair

value, and expands disclosure about such fair value measurements. SFAS No. 157 is effective for fiscal years beginning after

November 15, 2007. The Company is currently assessing the impact of SFAS No. 157 on its consolidated financial position and

results of operations.

In September 2006, the FASB issued SFAS No. 158, “Employers' Accounting for Defined Benefit Pension and Other

Postretirement Plans” (SFAS No. 158). SFAS No. 158 requires that employers recognize on a prospective basis the funded status of

their defined benefit pension and other postretirement benefit plans on their consolidated balance sheet and recognize as a component

of other comprehensive income (loss), net of tax, the gains or losses and prior service costs or credits that arise during the period but

are not recognized as components of net periodic benefit cost. We adopted SFAS No. 158 as of December 31, 2006. See Note 22—

Pensions and Other Postretirement Benefits for additional disclosures required by SFAS No. 158 and the effects of adoption.

In February, 2007, the FASB issued SFAS No. 159 “The Fair Value Option for Financial Assets and Financial Liabilities (SFAS

No. 159). SFAS No. 159 permits entities to choose to measure many financial assets and financial liabilities at fair value. Unrealized

gains and losses on items for which the fair value option has been elected are reported in earnings. SFAS No. 159 is effective for fiscal

years beginning after November 15, 2007. The Company is currently assessing the impact of SFAS No. 159 on its consolidated

financial position and results of operations.

In September 2006, the FASB issued FASB Staff Position (“FSP”) AUG AIR-1 “Accounting for Planned Major Maintenance

Activities” (FSP AUG AIR-1). FSP AUG AIR-1 amends the guidance on

54