Honeywell 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

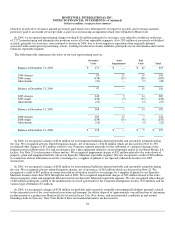

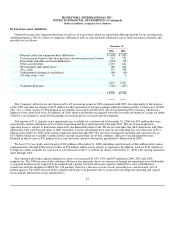

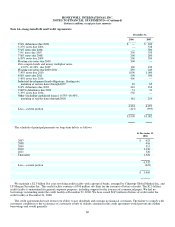

acquired businesses not expected to be realized, that was partially offset by a decrease in state tax net operating loss carryforwards (net

of federal impact) and the disallowance of foreign net operating losses for which a valuation allowance had previously been provided.

The 2004 increase in the valuation allowance was primarily due to an increase in state tax net operating loss carryforwards (net of

federal impact) and foreign net operating and capital losses that are not expected to be realized, partially offset by a decrease for

foreign tax credits which we now believe will be utilized due to the extension of the foreign tax credit carryforward period from five

to 10 years under the Act.

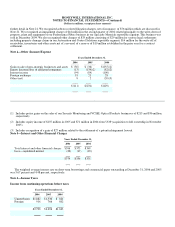

Federal income taxes have not been provided on undistributed earnings of the majority of our international subsidiaries as it is our

intention to reinvest these earnings into the respective businesses. At December 31, 2006 Honeywell has not provided for U.S. federal

income and foreign withholding taxes on approximately $2.9 billion of such earnings of our non-U.S. operations. It is not practicable

to estimate the amount of tax that might be payable if some or all of such earnings were to be remitted, and foreign tax credits would

be available to reduce or eliminate the resulting U.S. income tax liability.

In 2005, the Company was effected by actions taken relating to certain provisions in the Act which was signed into law in October

2004 and provides for a variety of changes in the tax law including incentives to repatriate undistributed earnings of foreign

subsidiaries, a phased elimination of the extra-territorial income exclusion, and a domestic manufacturing benefit. More specifically,

the Act created a temporary incentive for U.S. corporations to repatriate accumulated income earned outside the U.S. by providing an

85 percent dividends received deduction for certain dividends from controlled foreign corporations. In 2005, we repatriated

approximately $2.7 billion of foreign earnings, of which $2.2 billion received the benefit under the Act, with an income tax provision

of $155 million. No additional amounts were repatriated under the Act in 2006.

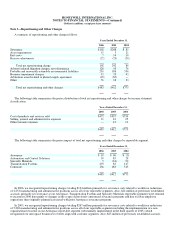

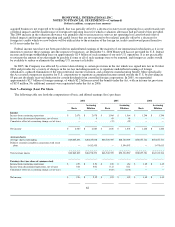

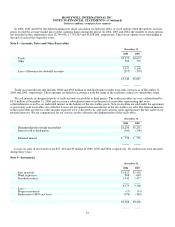

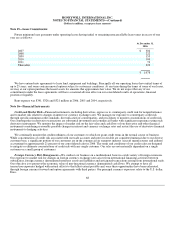

Note 7—Earnings (Loss) Per Share

The following table sets forth the computations of basic and diluted earnings (loss) per share:

2006 2005 2004

Basic Assuming

Dilution Basic Assuming

Dilution Basic Assuming

Dilution

Income

Income from continuing operations $ 2,078 $ 2,078 $ 1,564 $ 1,564 $ 1,246 $ 1,246

Income from discontinued operations, net of taxes 5 5 95 95 — —

Cumulative effect of accounting change, net of taxes — — (21) (21) — —

Net income $ 2,083 $ 2,083 $ 1,638 $ 1,638 $ 1,246 $ 1,246

Average shares

Average shares outstanding 820,845,838 820,845,838 848,740,395 848,740,395 858,857,721 858,857,721

Dilutive securities issuable in connection with stock

plans

—

5,432,435

—

3,594,592

—

3,475,613

Total average shares 820,845,838 826,278,273 848,740,395 852,334,987 858,857,721 862,333,334

Earnings (loss) per share of common stock

Income from continuing operations $ 2.53 $ 2.51 $ 1.85 $ 1.84 $ 1.45 $ 1.45

Income from discontinued operations, net of taxes 0.01 0.01 0.11 0.11 — —

Cumulative effect of accounting change, net of taxes — — (0.03) (0.03) — —

Net income $ 2.54 $ 2.52 $ 1.93 $ 1.92 $ 1.45 $ 1.45

62