Hertz 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

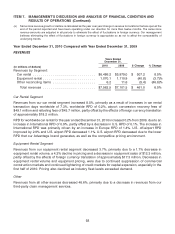

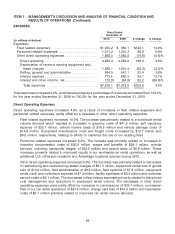

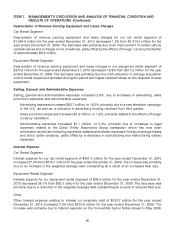

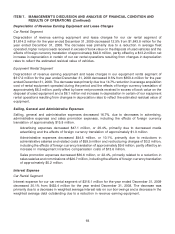

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

The ratio of adjusted pre-tax income to revenues for our two reportable segments has historically

reflected the different environments in which they operate, although the difference has been eliminated

for the year ended December 31, 2009 because of the more rapid decline in revenues in our equipment

rental segment. Our infrastructure costs are higher within our car rental segment due to the number and

type of locations in which it operates and the corresponding headcount. In addition, our revenue earning

equipment in our equipment rental segment generates lower depreciation expense due to its longer

estimated useful life.

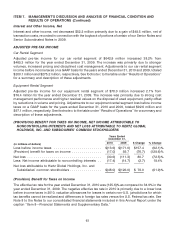

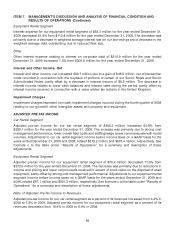

BENEFIT FOR TAXES ON INCOME, NET INCOME ATTRIBUTABLE TO NONCONTROLLING

INTERESTS AND NET LOSS ATTRIBUTABLE TO HERTZ GLOBAL HOLDINGS, INC. AND

SUBSIDIARIES’ COMMON STOCKHOLDERS

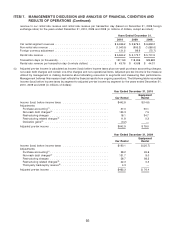

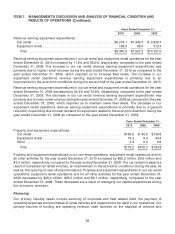

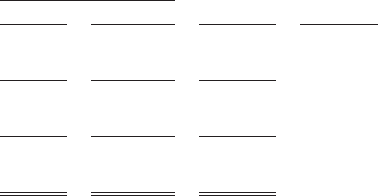

Years Ended

December 31,

2009 2008 $ Change % Change

(in millions of dollars)

Loss before income taxes ...................... $(171.0) $(1,382.8) $1,211.8 (87.6)%

Benefit for taxes on income ..................... 59.7 196.9 (137.2) (69.7)%

Net loss ................................... (111.3) (1,185.9) 1,074.6 (90.6)%

Less: Net income attributable to noncontrolling interests (14.7) (20.8) 6.1 (29.4)%

Net loss attributable to Hertz Global Holdings, Inc. and

Subsidiaries’ common stockholders ............. $(126.0) $(1,206.7) $1,080.7 (89.6)%

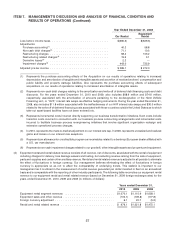

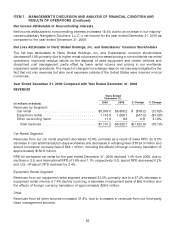

Benefit for Taxes on Income

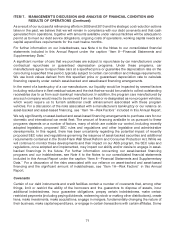

The effective tax rate for the year ended December 31, 2009 was 34.9% as compared to 14.2% in the

year ended December 31, 2008. The benefit for taxes on income decreased 69.7%, primarily due to

non-recurring 2008 impairment charges. See Note 8 to the Notes to our consolidated financial

statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’

Net Income Attributable to Noncontrolling Interests

Net income attributable to noncontrolling interests decreased 29.4% due to a decrease in our majority-

owned subsidiary Navigation Solutions, L.L.C.’s net income for the year ended December 31, 2009 as

compared to the year ended December 31, 2008.

Net Loss Attributable to Hertz Global Holdings, Inc. and Subsidiaries’ Common Stockholders

The net loss attributable to Hertz Global Holdings, Inc. and Subsidiaries’ common stockholders

decreased 89.6% primarily due to the impairment of our goodwill, other intangible assets and property

and equipment in 2008 and strong cost management performance, partly offset by lower rental volume

and pricing in our worldwide car and equipment rental operations, as well as the net effect of other

contributing factors noted above. The impact of changes in exchange rates on the net loss was mitigated

by the fact that not only revenues but also most expenses outside of the United States were incurred in

local currencies.

66