Hertz 2010 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

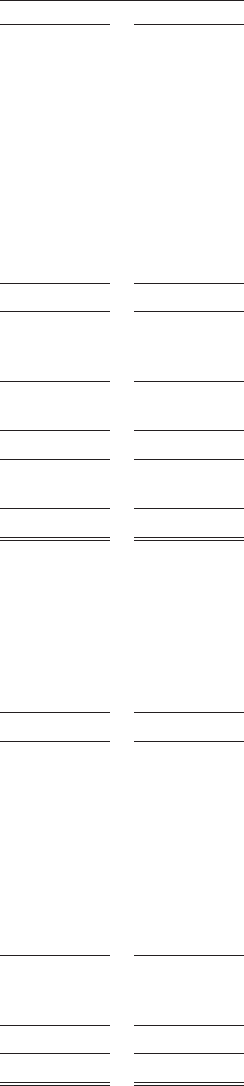

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In Thousands of Dollars)

December 31,

2010 2009

ASSETS

Cash and cash equivalents ................................ $ 2,374,170 $ 985,642

Restricted cash and cash equivalents ........................ 207,576 365,159

Receivables, less allowance for doubtful accounts of $19,708 and

$21,268 ............................................ 1,356,553 1,325,332

Inventories, at lower of cost or market ........................ 87,429 93,415

Prepaid expenses and other assets .......................... 352,782 300,125

Revenue earning equipment, at cost:

Cars .............................................. 8,435,077 8,205,579

Less accumulated depreciation .......................... (1,199,355) (1,186,299)

Other equipment ...................................... 2,756,101 2,582,029

Less accumulated depreciation .......................... (1,052,414) (749,724)

Total revenue earning equipment ....................... 8,939,409 8,851,585

Property and equipment, at cost:

Land, buildings and leasehold improvements ................. 1,071,987 1,023,891

Service equipment and other ............................. 900,271 838,906

1,972,258 1,862,797

Less accumulated depreciation .......................... (808,689) (674,668)

Total property and equipment ......................... 1,163,569 1,188,129

Other intangible assets, net ............................... 2,550,559 2,597,682

Goodwill ............................................. 300,174 295,350

Total assets ...................................... $17,332,221 $16,002,419

LIABILITIES AND EQUITY

Accounts payable ...................................... $ 944,973 $ 658,671

Accrued salaries and other compensation ..................... 439,217 465,281

Other accrued liabilities .................................. 630,865 559,541

Accrued taxes ......................................... 108,940 108,356

Debt ................................................ 11,306,429 10,364,367

Public liability and property damage ......................... 278,685 277,828

Deferred taxes on income ................................. 1,491,789 1,470,934

Total liabilities ..................................... 15,200,898 13,904,978

Commitments and contingencies

Equity:

Hertz Global Holdings Inc. and Subsidiaries stockholders’ equity

Preferred Stock, $0.01 par value, 200,000,000 shares authorized, no

shares issued and outstanding .......................... — —

Common Stock, $0.01 par value, 2,000,000,000 shares authorized,

413,462,889 and 410,245,225 shares issued and outstanding .... 4,135 4,102

Additional paid-in capital ................................ 3,183,225 3,141,695

Accumulated deficit .................................... (1,110,362) (1,062,318)

Accumulated other comprehensive income (loss) .............. 37,823 (3,331)

Total Hertz Global Holdings, Inc. and Subsidiaries stockholders’

equity ......................................... 2,114,821 2,080,148

Noncontrolling interest ................................... 16,502 17,293

Total equity ...................................... 2,131,323 2,097,441

Total liabilities and equity ............................ $17,332,221 $16,002,419

The accompanying notes are an integral part of these financial statements.

81