Hertz 2010 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

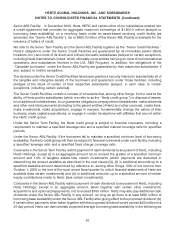

Canadian Securitization

In May 2007, certain foreign subsidiaries entered into a credit agreement that provides for aggregate

maximum borrowings of CAD$225 million (the equivalent of $224.8 million as of December 31, 2010)

(subject to borrowing base availability) on a revolving basis under an asset-backed securitization facility

(as amended, the ‘‘Canadian Securitization’’). The Canadian Securitization is the primary fleet financing

for our rental car operations in Canada. The lenders under the Canadian Securitization have been

granted a security interest primarily in the owned rental car fleet used in our car rental operations in

Canada and certain contractual rights related to such vehicles.

Australian Securitization

In November 2010, certain foreign subsidiaries entered into a credit agreement that provides for

aggregate maximum borrowings of A$250 million (the equivalent of $254.5 million as of December 31,

2010) (subject to borrowing base availability) on a revolving basis under an asset-backed securitization

facility (the ‘‘Australian Securitization’’). The Australian Securitization is the primary fleet financing for our

rental car operations in Australia. The lenders under the Australian Securitization have been granted a

security interest primarily in the owned rental car fleet used in our car rental operations in Australia and

certain contractual rights related to such vehicles. In connection with the issuance of the Australian

Securitization, an interest rate cap was purchased by the foreign subsidiaries. Concurrently, Hertz sold

an offsetting interest rate cap, thereby neutralizing the hedge on a consolidated basis and reducing the

net cost of the hedge. See Note 13—Financial Instruments.

Brazilian Fleet Financing Facility

In December 2010, a foreign subsidiary amended its asset-based credit facility (as amended, the

‘‘Brazilian Fleet Financing Facility’’) which was the primary fleet financing for our rental car operations in

Brazil. In February 2011, we paid off the maturing amount of the Brazilian Fleet Financing Facility and the

collateral thereunder was released and the guaranty thereunder was terminated.

Capitalized Leases

References to the ‘‘Capitalized Leases’’ include the capitalized lease financings outstanding in the

United Kingdom (the ‘‘U.K. Leveraged Financing’’), Australia, The Netherlands and the United States.

The amount available under the U.K. Leveraged Financing, which is the largest portion of the Capitalized

Leases, increases over the term of the facility to £195.0 million (the equivalent of $302.3 million as of

December 31, 2010).

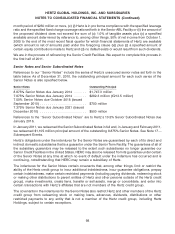

Restricted Net Assets

As a result of the contractual restrictions on Hertz’s or its subsidiaries’ ability to pay dividends to us

(directly or indirectly) under various terms of our debt, as of December 31, 2010, the restricted net assets

of our subsidiaries exceeded 25% of our total consolidated net assets.

Financial Covenant Compliance

As of December 31, 2010, we were in compliance with all financial covenants in our various debt

instruments. Based on our current projections, we believe that we will remain in compliance with our

corporate debt covenants over the next twelve months.

102