Hertz 2010 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 8—Taxes on Income

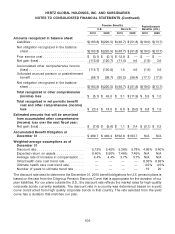

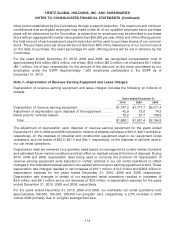

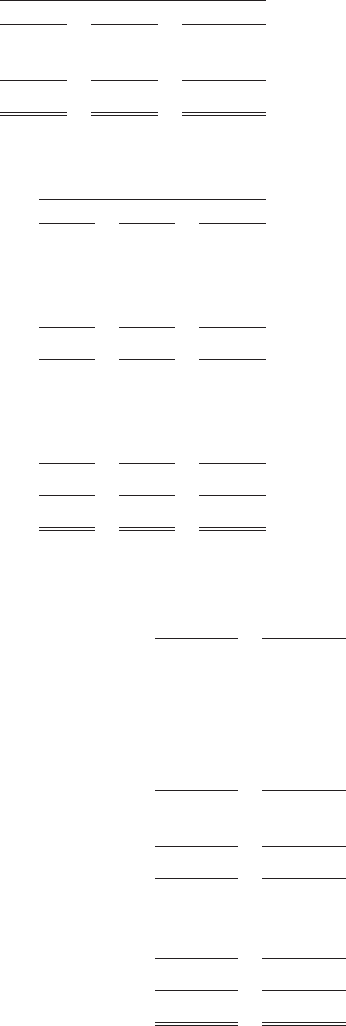

The components of loss before income taxes for the periods were as follows (in millions of dollars):

Years ended December 31,

2010 2009 2008

Domestic .............................. $(127.1) $(149.3) $(1,166.7)

Foreign ............................... 113.5 (21.7) (216.1)

Total ................................ $ (13.6) $(171.0) $(1,382.8)

The total provision (benefit) for taxes on income consists of the following (in millions of dollars):

Years ended December 31,

2010 2009 2008

Current:

Federal ................................. $ 0.1 $ 0.4 $ (1.5)

Foreign ................................. 41.5 15.8 36.5

State and local ........................... 1.5 (1.2) 3.0

Total current ............................ 43.1 15.0 38.0

Deferred:

Federal ................................. (24.7) (34.1) (192.9)

Foreign ................................. 1.3 (23.0) (12.7)

State and local ........................... (2.7) (17.6) (29.3)

Total deferred ........................... (26.1) (74.7) (234.9)

Total provision (benefit) .................. $17.0 $(59.7) $(196.9)

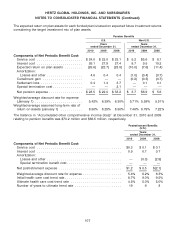

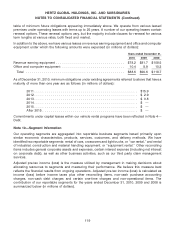

The principal items of the U.S. and foreign net deferred tax assets and liabilities at December 31, 2010

and 2009 are as follows (in millions of dollars):

2010 2009

Deferred Tax Assets:

Employee benefit plans ..................................... $ 83.3 $ 88.0

Net operating loss carryforwards .............................. 1,407.4 1,135.2

Foreign tax credit carryforwards ............................... 20.8 20.8

Federal, state and foreign local tax credit carryforwards .............. 4.8 8.2

Accrued and prepaid expenses ............................... 224.3 206.1

Total Deferred Tax Assets .................................... 1,740.6 1,458.3

Less: Valuation Allowance ................................... (185.8) (167.8)

Total Net Deferred Tax Assets ................................. 1,554.8 1,290.5

Deferred Tax Liabilities:

Depreciation on tangible assets ............................... (2,004.1) (1,694.4)

Intangible assets .......................................... (1,042.5) (1,067.0)

Total Deferred Tax Liabilities .................................. (3,046.6) (2,761.4)

Net Deferred Tax Liability .................................. $(1,491.8) $(1,470.9)

115