Hertz 2010 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

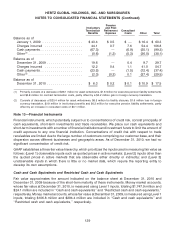

Debt

For borrowings with an initial maturity of 93 days or less, fair value approximates carrying value because

of the short-term nature of these instruments. For all other debt, fair value is estimated based on quoted

market rates as well as borrowing rates currently available to us for loans with similar terms and average

maturities (Level 2 inputs). The aggregate fair value of all debt at December 31, 2010 was

$12,063.5 million, compared to its aggregate carrying value of $11,429.6 million. The aggregate fair

value of all debt at December 31, 2009 was $10,795.7 million, compared to its aggregate carrying value

of $10,530.4 million.

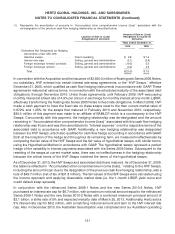

Derivative Instruments and Hedging Activities

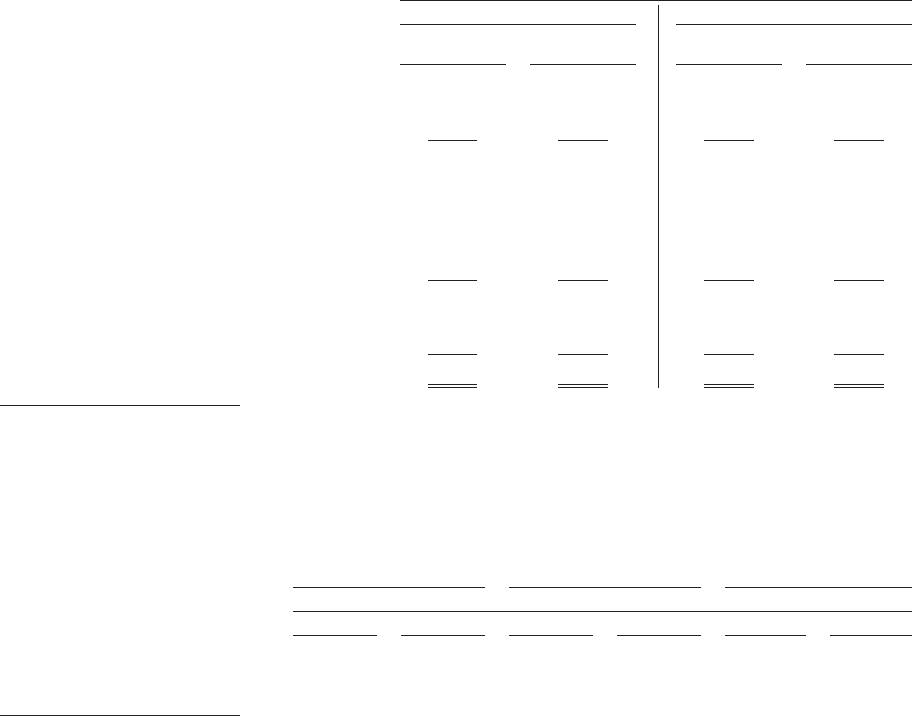

The following table summarizes our financial assets and liabilities measured at fair value on a recurring

basis as of December 31, 2010 and 2009 (in millions of dollars):

Fair Value of Derivative Instruments(1)

Asset Derivatives(2) Liability Derivatives(2)

December 31, December 31, December 31, December 31,

2010 2009 2010 2009

Derivatives designated as hedging

instruments under ASC 815:

HVF interest rate swaps ........... $ — $ — $ — $12.8

Derivatives not designated as hedging

instruments under ASC 815:

Gasoline swaps ................. 3.1 2.2 — —

Interest rate caps ................ 7.2 8.2 7.2 5.6

Foreign exchange forward contracts . . 2.6 7.6 11.1 5.7

Foreign exchange options ......... 0.1 — — —

Total derivatives not designated as

hedging instruments under ASC

815 ...................... 13.0 18.0 18.3 11.3

Total derivatives .................. $13.0 $18.0 $18.3 $24.1

(1) All fair value measurements were primarily based upon significant observable (Level 2) inputs.

(2) All asset derivatives are recorded in ‘‘Prepaid expenses and other assets’’ and all liability derivatives are recorded in ‘‘Other

accrued liabilities’’ on our consolidated balance sheets.

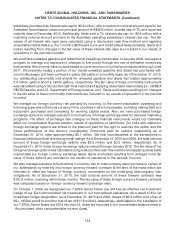

Amount of Gain or

Amount of Gain or (Loss) Reclassified

(Loss) Recognized in from Accumulated Amount of Gain or

Other Comprehensive Other Comprehensive (Loss) Recognized in

Income on Derivative Income into Income Income on Derivative

(Effective Portion) (Effective Portion) (Ineffective Portion)

Years ended December 31,

2010 2009 2010 2009 2010 2009

Derivatives in ASC 815 Cash

Flow Hedging Relationship:

HVF interest rate swaps ..... $12.8 $(12.8) $(85.1) $(74.6)(1) $— $—

Note:The location of both the effective portion reclassified from ‘‘Accumulated other comprehensive income (loss)’’ into income

and the ineffective portion recognized in income is in ‘‘Interest expense’’ on our consolidated statement of operations.

130