Hertz 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

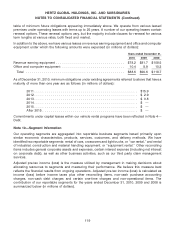

The significant items in the reconciliation of the statutory and effective income tax rates consisted of the

following:

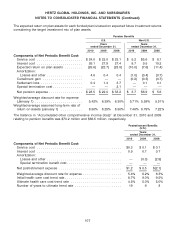

Years ended December 31,

2010 2009 2008

Statutory Federal Tax Rate ................................ 35.0% 35.0% 35.0%

Foreign tax differential ................................... 116.7 21.1 (0.5)

State and local income taxes, net of federal income tax benefit ...... 14.1 6.0 0.7

Change in state statutory rates, net of federal income tax benefit ..... (12.1) 3.5 0.1

Effect of impairment charges ............................... — — (16.6)

Federal permanent differences ............................. 6.3 2.0 0.1

Withholding taxes ....................................... (62.5) (4.8) (0.5)

Uncertain tax positions ................................... (26.7) (2.8) (0.4)

Change in valuation allowance ............................. (202.2) (26.2) (3.8)

All other items, net ...................................... 5.8 1.1 0.1

Effective Tax Rate ..................................... (125.6)% 34.9% 14.2%

The effective tax rate for the year ended December 31, 2010 was (125.6)% as compared to 34.9% in the

year ended December 31, 2009. The negative effective tax rate in 2010 is primarily due to a lower loss

before income taxes in 2010, valuation allowances for losses in certain non-U.S. jurisdictions for which

tax benefits cannot be realized and differences in foreign tax rates versus the U.S. Federal tax rate. The

foreign rate differential includes the effects of changes in foreign statutory tax rates, foreign permanent

differences and the impact of the newly enacted tax law in France which became effective for 2010. The

increase in the 2009 effective tax rate versus 2008 is primarily due to nonrecurring impairment losses in

2008.

As of December 31, 2010, our foreign subsidiaries have an immaterial amount of net undistributed

earnings. Deferred tax liabilities have not been recorded for such earnings because it is management’s

current intention to permanently reinvest undistributed earnings offshore. It is not practicable to estimate

the amount of such deferred tax liabilities. If, in the future, undistributed earnings are repatriated to the

United States, or it is determined such earnings will be repatriated in the foreseeable future, deferred tax

liabilities will be recorded.

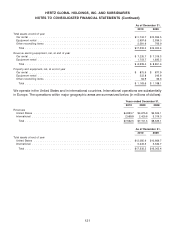

As of December 31, 2010, total unrecognized tax benefits were $27.2 million, all of which, if recognized,

would favorably impact the effective tax rate in future periods. A reconciliation of the beginning and

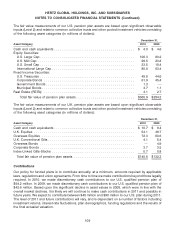

ending amount of unrecognized tax benefits is as follows (in millions of dollars):

2010 2009 2008

Balance at January 1 ....................................... $25.6 $21.7 $ 35.5

Increase (decrease) attributable to tax positions taken during prior periods . 0.3 1.1 (5.7)

Increase attributable to tax positions taken during the current year ....... 1.3 3.1 5.2

Decrease attributable to settlements with taxing authorities ............ — (0.3) (13.3)

Balance at December 31 ..................................... $27.2 $25.6 $ 21.7

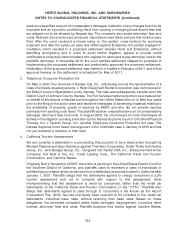

We conduct business globally and, as a result, file one or more income tax returns in the U.S. and

non-U.S. jurisdictions. In the normal course of business we are subject to examination by taxing

authorities throughout the world. The open tax years for these jurisdictions span from 1998 to 2010. We

117