Hertz 2010 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

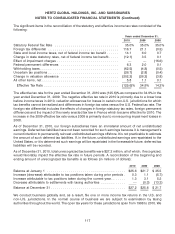

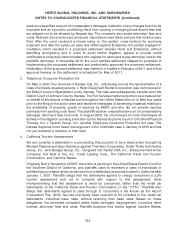

are currently under audit by the Internal Revenue Service for tax years 2006 to 2008. Several U.S. state

and non-U.S. jurisdictions are under audit.

In many cases the uncertain tax positions are related to tax years that remain subject to examination by

the relevant taxing authorities. It is reasonable that approximately $8.5 million of unrecognized tax

benefits may reverse within the next twelve months due to settlement with the relevant taxing authorities

and/or the filing of amended income tax returns.

Net, after-tax interest and penalties related to the liabilities for unrecognized tax benefits are classified as

a component of ‘‘(Provision) benefit for taxes on income’’ in the consolidated statement of operations.

During the years ended December 31, 2010, 2009 and 2008, approximately $0.2 million, $(0.2) million

and $0.6 million, respectively, in net, after-tax interest and penalties were recognized. As of

December 31, 2010 and 2009, approximately $1.8 million and $5.8 million, respectively, of net, after-tax

interest and penalties was accrued in our consolidated balance sheet.

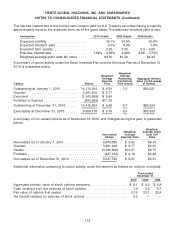

Note 9—Lease and Concession Agreements

We have various concession agreements, which provide for payment of rents and a percentage of

revenue with a guaranteed minimum, and real estate leases under which the following amounts were

expensed (in millions of dollars):

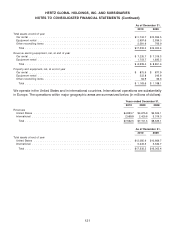

Years ended December 31,

2010 2009 2008

Rents ................................................ $133.9 $133.2 $144.2

Concession fees:

Minimum fixed obligations ................................ 252.0 260.1 251.0

Additional amounts, based on revenues ...................... 278.7 231.5 268.8

Total .............................................. $664.6 $624.8 $664.0

For the years ended December 31, 2010, 2009 and 2008, sublease income reduced rent expense

included in the above table by $4.5 million, $5.0 million and $5.4 million, respectively.

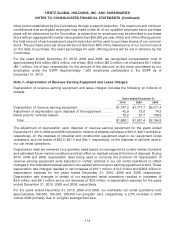

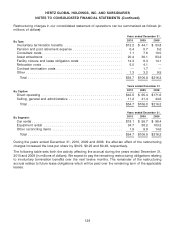

As of December 31, 2010, minimum obligations under existing agreements referred to above are

approximately as follows (in millions of dollars):

Rents Concessions

2011 ..................................................... $119.4 $312.0

2012 ..................................................... 97.9 267.1

2013 ..................................................... 78.7 218.1

2014 ..................................................... 61.5 148.9

2015 ..................................................... 45.6 103.3

Years after 2015 ............................................. 161.0 364.5

The future minimum rent payments in the above table have been reduced by minimum future sublease

rental inflows in aggregate of $17.8 million.

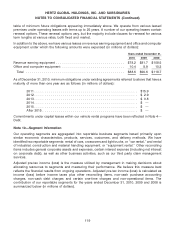

Many of our concession agreements and real estate leases require us to pay or reimburse operating

expenses, such as common area charges and real estate taxes, to pay concession fees above

guaranteed minimums or additional rent based on a percentage of revenues or sales (as defined in

those agreements) arising at the relevant premises, or both. Such obligations are not reflected in the

118