Hertz 2010 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

may be held responsible could be substantial. The probable expenses that we expect to incur for such

matters have been accrued, and those expenses are reflected in our consolidated financial statements.

As of December 31, 2010 and 2009, the aggregate amounts accrued for environmental liabilities,

including liability for environmental indemnities, reflected in our consolidated balance sheets in ‘‘Other

accrued liabilities’’ were $1.6 million and $2.0 million, respectively. The accrual generally represents the

estimated cost to study potential environmental issues at sites deemed to require investigation or

clean-up activities, and the estimated cost to implement remediation actions, including on-going

maintenance, as required. Cost estimates are developed by site. Initial cost estimates are based on

historical experience at similar sites and are refined over time on the basis of in-depth studies of the sites.

For many sites, the remediation costs and other damages for which we ultimately may be responsible

cannot be reasonably estimated because of uncertainties with respect to factors such as our connection

to the site, the materials there, the involvement of other potentially responsible parties, the application of

laws and other standards or regulations, site conditions, and the nature and scope of investigations,

studies, and remediation to be undertaken (including the technologies to be required and the extent,

duration, and success of remediation).

Risk Management

For a discussion of additional risks arising from our operations, including vehicle liability, general liability

and property damage insurable risks, see ‘‘Item 1—Business—Risk Management’’ in this Annual

Report.

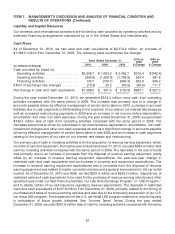

Market Risks

We are exposed to a variety of market risks, including the effects of changes in interest rates, foreign

currency exchange rates and fluctuations in gasoline prices. We manage our exposure to these market

risks through our regular operating and financing activities and, when deemed appropriate, through the

use of derivative financial instruments. Derivative financial instruments are viewed as risk management

tools and have not been used for speculative or trading purposes. In addition, derivative financial

instruments are entered into with a diversified group of major financial institutions in order to manage our

exposure to counterparty nonperformance on such instruments. For more information on these

exposures, see Note 13 to the Notes to our consolidated financial statements included in this Annual

Report under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Interest Rate Risk

From time to time, we may enter into interest rate swap agreements and/or interest rate cap agreements

to manage interest rate risk. See Notes 4 and 13 to the Notes to our audited annual consolidated

financial statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’

We have a significant amount of debt with variable rates of interest based generally on LIBOR, Euro

inter-bank offered rate, or ‘‘EURIBOR,’’ or their equivalents for local currencies or bank conduit

commercial paper rates plus an applicable margin. Increases in interest rates could therefore

significantly increase the associated interest payments that we are required to make on this debt. See

Note 4 to the Notes to our audited annual consolidated financial statements included in this Annual

Report under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

We have assessed our exposure to changes in interest rates by analyzing the sensitivity to our earnings

assuming various changes in market interest rates. Assuming a hypothetical increase of one percentage

76