Hertz 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

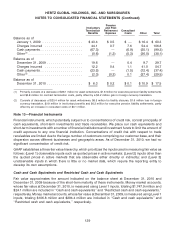

(1) Represents the amortization of amounts in ‘‘Accumulated other comprehensive income (loss)’’ associated with the

de-designation of the previous cash flow hedging relationship as described below.

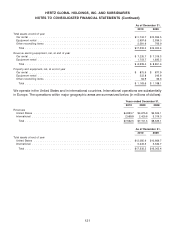

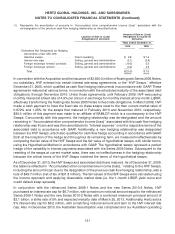

Amount of Gain or (Loss)

Location of Gain or (Loss) Recognized in Income on

Recognized on Derivative Derivative

Years ended December 31,

2010 2009

Derivatives Not Designated as Hedging

Instruments under ASC 815:

Gasoline swaps ............... Direct operating $ 2.8 $ 7.4

Interest rate caps .............. Selling, general and administrative (3.1) (2.6)

Foreign exchange forward contracts . . Selling, general and administrative (19.5) 2.0

Foreign exchange options ......... Selling, general and administrative (0.2) 0.2

Total ..................... $(20.0) $ 7.0

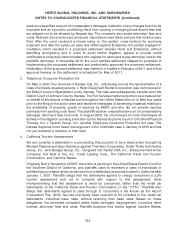

In connection with the Acquisition and the issuance of $3,550.0 million of floating rate Series 2005 Notes,

our subsidiary, HVF, entered into certain interest rate swap agreements, or the ‘‘HVF Swaps,’’ effective

December 21, 2005, which qualified as cash flow hedging instruments in accordance with GAAP. These

agreements matured at various terms, in connection with the scheduled maturity of the associated debt

obligations, through November 2010. Under these agreements, until February 2009, HVF was paying

monthly interest at a fixed rate of 4.5% per annum in exchange for monthly interest at one-month LIBOR,

effectively transforming the floating rate Series 2005 Notes to fixed rate obligations. In March 2009, HVF

made a cash payment to have the fixed rate on these swaps reset to the then current market rates of

0.872% and 1.25% for the swaps that matured in February 2010 and November 2010, respectively.

$80.4 million of this payment was made to an affiliate of BAMLCP which is a counterparty to the HVF

Swaps. Concurrently with this payment, the hedging relationship was de-designated and the amount

remaining in ‘‘Accumulated other comprehensive income (loss)’’ associated with this cash flow hedging

relationship was frozen and was then amortized into ‘‘Interest expense’’ over the respective terms of the

associated debt in accordance with GAAP. Additionally, a new hedging relationship was designated

between the HVF Swaps, which also qualified for cash flow hedge accounting in accordance with GAAP.

Both at the inception of the hedge and throughout its remaining term, we measured ineffectiveness by

comparing the fair value of the HVF Swaps and the fair value of hypothetical swaps, with similar terms,

using the Hypothetical Method in accordance with GAAP. The hypothetical swaps represent a perfect

hedge of the variability in interest payments associated with the Series 2005 Notes. Subsequent to the

resetting of the swaps at current market rates, there was no ineffectiveness in the hedging relationship

because the critical terms of the HVF Swaps matched the terms of the hypothetical swaps.

As of December 31, 2010, the HVF Swaps and associated debt have matured. As of December 31, 2009,

the balance reflected in ‘‘Accumulated other comprehensive income (loss),’’ relating to the HVF Swaps,

including the amount frozen due to the designation of the previous cash flow hedging relationship, was a

loss of $49.7 million (net of tax of $31.8 million). The fair values of the HVF Swaps were calculated using

the income approach and applying observable market data (i.e. the 1-month LIBOR yield curve and

credit default swap spreads).

In conjunction with the refinanced Series 2009-1 Notes and the new Series 2010-2 Notes, HVF

purchased an interest rate cap for $6.7 million, with a maximum notional amount equal to the refinanced

Series 2009-1 Notes and the new Series 2010-2 Notes with a combined maximum principal amount of

$2.1 billion, a strike rate of 5% and expected maturity date of March 25, 2013. Additionally, Hertz sold a

5% interest rate cap for $6.2 million, with a matching notional amount and term to the HVF interest rate

cap. Also in December 2010, the Australian Securitization was completed and our Australian operating

131