Hertz 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

doubtful accounts is based on our historical experience and our judgment as to the likelihood of ultimate

payment. Actual receivables are written-off against the allowance for doubtful accounts when we

determine the balance will not be collected. Bad debt expense is reflected as a component of Selling,

general and administrative in our consolidated statements of operations.

Depreciable Assets

The provisions for depreciation and amortization are computed on a straight-line basis over the

estimated useful lives of the respective assets, or in the case of revenue earning equipment over the

estimated holding period, as follows:

Revenue Earning Equipment:

Cars ........................... 4 to 26 months

Other equipment .................. 24 to 108 months

Buildings .......................... 4 to 50 years

Furniture and fixtures ................. 1 to 15 years

Capitalized internal use software ......... 1 to 15 years

Service cars and service equipment ...... 1 to 13 years

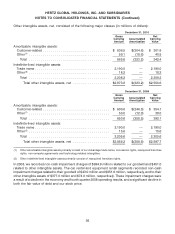

Other intangible assets ................ 3 to 15 years

Leasehold improvements .............. The shorter of their economic lives or the lease term.

We follow the practice of charging maintenance and repairs, including the cost of minor replacements, to

maintenance expense accounts. Costs of major replacements of units of property are capitalized to

property and equipment accounts and depreciated on the basis indicated above. Gains and losses on

dispositions of property and equipment are included in income as realized. When revenue earning

equipment is acquired, we estimate the period that we will hold the asset, primarily based on historical

measures of the amount of rental activity (e.g., automobile mileage and equipment usage) and the

targeted age of equipment at the time of disposal. We also estimate the residual value of the applicable

revenue earning equipment at the expected time of disposal. The residual values for rental vehicles are

affected by many factors, including make, model and options, age, physical condition, mileage, sale

location, time of the year and channel of disposition (e.g., auction, retail, dealer direct). The residual

value for rental equipment is affected by factors which include equipment age and amount of usage.

Depreciation is recorded on a straight-line basis over the estimated holding period. Depreciation rates

are reviewed on a quarterly basis based on management’s ongoing assessment of present and

estimated future market conditions, their effect on residual values at the time of disposal and the

estimated holding periods. Market conditions for used vehicle and equipment sales can also be affected

by external factors such as the economy, natural disasters, fuel prices and incentives offered by

manufacturers of new cars. These key factors are considered when estimating future residual values and

assessing depreciation rates. As a result of this ongoing assessment, we make periodic adjustments to

depreciation rates of revenue earning equipment in response to changed market conditions. Upon

disposal of revenue earning equipment, depreciation expense is adjusted for the difference between the

net proceeds received and the remaining net book value.

Environmental Liabilities

The use of automobiles and other vehicles is subject to various governmental controls designed to limit

environmental damage, including that caused by emissions and noise. Generally, these controls are met

by the manufacturer, except in the case of occasional equipment failure requiring repair by us. To comply

with environmental regulations, measures are taken at certain locations to reduce the loss of vapor

88