Hertz 2010 Annual Report Download - page 115

Download and view the complete annual report

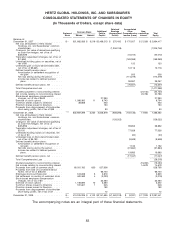

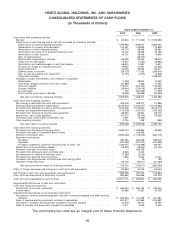

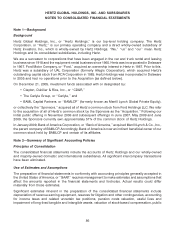

Please find page 115 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

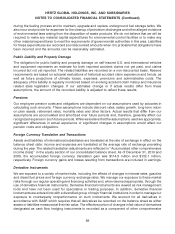

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

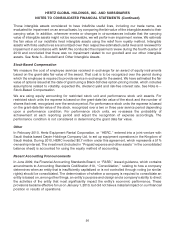

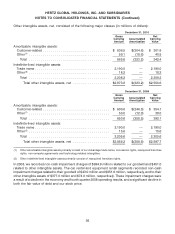

Those intangible assets considered to have indefinite useful lives, including our trade name, are

evaluated for impairment on an annual basis, by comparing the fair value of the intangible assets to their

carrying value. In addition, whenever events or changes in circumstances indicate that the carrying

value of intangible assets might not be recoverable, we will perform an impairment review. We estimate

the fair value of our indefinite lived intangible assets using the relief from royalty method. Intangible

assets with finite useful lives are amortized over their respective estimated useful lives and reviewed for

impairment in accordance with GAAP. We conducted the impairment review during the fourth quarter of

2010 and concluded that there was no impairment related to our goodwill and our other intangible

assets. See Note 3—Goodwill and Other Intangible Assets.

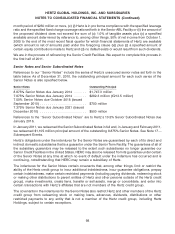

Stock-Based Compensation

We measure the cost of employee services received in exchange for an award of equity instruments

based on the grant-date fair value of the award. That cost is to be recognized over the period during

which the employee is required to provide service in exchange for the award. We have estimated the fair

value of options issued at the date of grant using a Black-Scholes option-pricing model, which includes

assumptions related to volatility, expected life, dividend yield and risk-free interest rate. See Note 6—

Stock-Based Compensation.

We are using equity accounting for restricted stock unit and performance stock unit awards. For

restricted stock units the expense is based on the grant-date fair value of the stock and the number of

shares that vest, recognized over the service period. For performance stock units the expense is based

on the grant-date fair value of the stock, recognized over a two or three year service period depending

upon a performance condition. For performance stock units, we re-assess the probability of

achievement at each reporting period and adjust the recognition of expense accordingly. The

performance condition is not considered in determining the grant date fair value.

Other

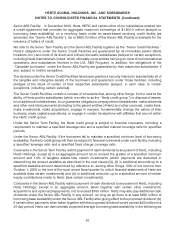

In February 2010, Hertz Equipment Rental Corporation, or ‘‘HERC,’’ entered into a joint venture with

Saudi Arabia based Dayim Holdings Company Ltd. to set up equipment operations in the Kingdom of

Saudi Arabia. During 2010, HERC invested $0.7 million under this agreement, which represents a 51%

ownership interest. The investment (included in ‘‘Prepaid expense and other assets’’ in the consolidated

balance sheet) is accounted for using the equity method of accounting.

Recent Accounting Pronouncements

In June 2009, the Financial Accounting Standards Board, or ‘‘FASB,’’ issued guidance, which contains

amendments to Accounting Standards Codification 810, ‘‘Consolidation,’’ relating to how a company

determines when an entity that is insufficiently capitalized or is not controlled through voting (or similar

rights) should be consolidated. The determination of whether a company is required to consolidate an

entity is based on, among other things, an entity’s purpose and design and a company’s ability to direct

the activities of the entity that most significantly impact the entity’s economic performance. These

provisions became effective for us on January 1, 2010, but did not have a material impact on our financial

position or results of operations.

91