Hertz 2010 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

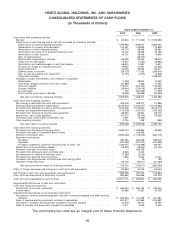

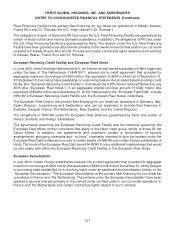

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

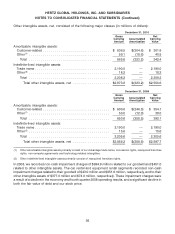

Note 4—Debt

Our debt consists of the following (in millions of dollars):

Average Fixed

Interest or

Rate at Floating December 31,

December 31, Interest

Facility 2010(1) Rate Maturity 2010 2009

Corporate Debt

Senior Term Facility ................. 2.02% Floating 12/2012 $ 1,345.0 $ 1,358.6

Senior ABL Facility .................. N/A Floating 2/2012 — —

Senior Notes ...................... 8.26% Fixed 1/2014 – 1/2021 3,229.6 2,054.7

Senior Subordinated Notes ............. 10.50% Fixed 1/2016 518.5 518.5

Promissory Notes ................... 7.45% Fixed 3/2011 – 1/2028 345.6 394.7

Convertible Senior Notes .............. 5.25% Fixed 6/2014 474.8 474.8

Other Corporate Debt ................ 4.74% Floating Various 22.0 22.3

Unamortized Discount (Corporate)(2) ....... (104.8) (134.2)

Total Corporate Debt .................. 5,830.7 4,689.4

Fleet Debt

U.S. ABS Program

U.S. Fleet Variable Funding Notes:

Series 2009-1(3) ................... 1.20% Floating 3/2013 1,488.0 —

Series 2010-2(3) ................... 1.26% Floating 3/2013 35.0 —

U.S. Fleet Medium Term Notes

Series 2005 Notes(4) ................ — Fixed 12/2010 — 2,875.0

Series 2009-2 Notes(3) ............... 4.95% Fixed 3/2013 – 3/2015 1,384.3 1,200.0

Series 2010-1 Notes(3) ............... 3.77% Fixed 2/2014 – 2/2018 749.8 —

Other Fleet Debt

U.S. Fleet Financing Facility ............ 1.51% Floating 12/2011 163.0 148.0

European Revolving Credit Facility ........ 4.47% Floating 6/2013 168.6 —

European Fleet Notes ................ 8.50% Fixed 7/2015 529.0 —

European Securitization(3) .............. 4.08% Floating 7/2012 236.9 —

Canadian Securitization(3) .............. 1.13% Floating 5/2011 80.4 55.6

Australian Securitization(3) .............. 6.24% Floating 12/2012 183.2 —

Brazilian Fleet Financing Facility .......... 15.56% Floating 2/2011 77.8 69.3

Belgian Fleet Financing Facility(4) ......... — Floating 12/2010 — 33.7

International ABS Fleet Financing Facility(4) . . . — Floating 12/2010 — 388.9

International Fleet Debt(4) .............. — Floating 12/2010 — 714.0

Capitalized Leases .................. 5.10% Floating 1/2011 – 2/2013 398.1 222.4

Unamortized Discount (Fleet) ........... (18.4) (31.9)

Total Fleet Debt ..................... 5,475.7 5,675.0

Total Debt ......................... $11,306.4 $10,364.4

(1) As applicable, reference is to the December 31, 2010 weighted average interest rate (weighted by principal balance).

(2) As of December 31, 2010 and 2009, $87.7 million and $107.4 million, respectively, of the unamortized corporate discount

relates to the 5.25% Convertible Senior Notes.

(3) Maturity reference is to the ‘‘expected final maturity date’’ as opposed to the subsequent ‘‘legal maturity date.’’ The expected

final maturity date is the date by which Hertz and investors in the relevant indebtedness expect the relevant indebtedness to

be repaid. The legal final maturity date is the date on which the relevant indebtedness is legally due and payable.

(4) Matured, refinanced and/or terminated in 2010.

95