Hertz 2010 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

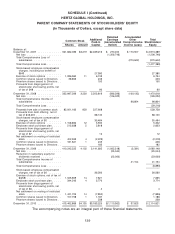

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

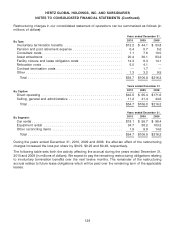

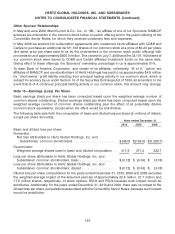

Note 16—Quarterly Financial Information (Unaudited)

Provided below is a summary of the quarterly operating results during 2010 and 2009 (in millions of

dollars, except per share data).

Earnings per share amounts are computed independently each quarter. As a result, the sum of each

quarter’s per share amount may not equal the total per share amount for the respective year.

First Second Third Fourth

Quarter Quarter Quarter Quarter

2010 2010 2010 2010

Revenues ................................. $1,660.9 $1,879.6 $2,186.3 $1,835.8

Income (loss) before income taxes ............... (157.8) (6.2) 158.3 (7.8)

Net income (loss) attributable to Hertz Global

Holdings, Inc. and Subsidiaries’ common

stockholders .............................. (150.4) (25.1) 156.6 (29.2)

Earnings (loss) per share, basic ................. $ (0.37) $ (0.06) $ 0.38 $ (0.07)

Earnings (loss) per share, diluted ................ $ (0.37) $ (0.06) $ 0.36 $ (0.07)

First Second Third Fourth

Quarter Quarter Quarter Quarter

2009 2009 2009 2009

Revenues ................................. $1,564.9 $1,754.5 $2,041.4 $1,740.7

Income (loss) before income taxes ............... (210.0) 30.7 75.8 (67.4)

Net income (loss) attributable to Hertz Global

Holdings, Inc. and Subsidiaries’ common

stockholders .............................. (163.5) 3.9 64.5 (30.9)

Earnings (loss) per share, basic ................. $ (0.51) $ 0.01 $ 0.16 $ (0.08)

Earnings (loss) per share, diluted ................ $ (0.51) $ 0.01 $ 0.15 $ (0.08)

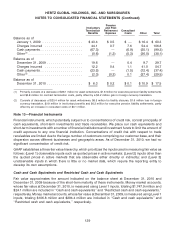

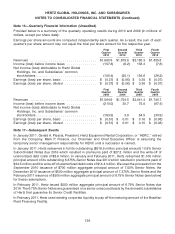

Note 17—Subsequent Events

In January 2011, Gerald A. Plescia, President, Hertz Equipment Rental Corporation, or ‘‘HERC,’’ retired

from the Company. Mark P. Frissora, our Chairman and Chief Executive Officer is assuming the

temporary senior management responsibility for HERC until a successor is named.

In January 2011, Hertz redeemed in full its outstanding ($518.5 million principal amount) 10.5% Senior

Subordinated Notes due 2016 which resulted in premiums paid of $27.2 million and the write-off of

unamortized debt costs of $8.6 million. In January and February 2011, Hertz redeemed $1,105 million

principal amount of its outstanding 8.875% Senior Notes due 2014 which resulted in premiums paid of

$24.5 million and the write-off of unamortized debt costs of $14.4 million. We used the proceeds from the

September 2010 issuance of $700 million aggregate principal amount of 7.50% Senior Notes, the

December 2010 issuance of $500 million aggregate principal amount of 7.375% Senior Notes and the

February 2011 issuance of $500 million aggregate principal amount of 6.75% Senior Notes (see below)

for these redemptions.

In February 2011, Hertz issued $500 million aggregate principal amount of 6.75% Senior Notes due

2019. The 6.75% Senior Notes are guaranteed on a senior unsecured basis by the domestic subsidiaries

of Hertz that guarantee its Senior Credit Facilities.

In February 2011, Hertz used existing corporate liquidity to pay off the maturing amount of the Brazilian

Fleet Financing Facility.

136