Hertz 2010 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

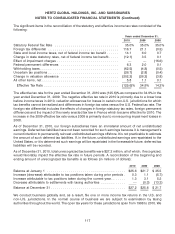

As of December 31, 2010, deferred tax assets of $1,111.5 million were recorded for unutilized U.S.

Federal Net Operating Losses, or ‘‘NOL,’’ carry forwards of $3,175.7 million. The total Federal NOL carry

forwards are $3,199.7 million of which $24.0 million relate to excess tax deductions associated with

stock option plans which have yet to reduce taxes payable. Upon the utilization of these carry forwards,

the associated tax benefits of approximately $8.4 million will be recorded to Additional Paid-in Capital.

The Federal NOLs begin to expire in 2025. State NOLs exclusive of the effects of the excess tax

deductions, have generated a deferred tax asset of $101.4 million. The state NOLs expire over various

years beginning in 2011 depending upon particular jurisdiction.

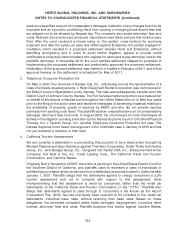

On January 1, 2009, Bank of America acquired Merrill Lynch & Co. For U.S. income tax purposes the

transaction, when combined with other unrelated transactions during the previous 36 months, resulted

in a change in control as that term is defined in Section 382 of the Internal Revenue Code. Consequently,

utilization of all pre-2009 U.S. net operating losses is subject to an annual limitation. We have calculated

the expected annual base limitation as well as additional limitation resulting from a net unrealized built in

gain as of the acquisition date and other adjustments. Based on the calculations, the limitation is not

expected to result in a loss of net operating losses or have a material adverse impact on taxes.

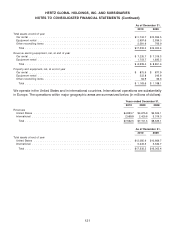

As of December 31, 2010, deferred tax assets of $196.3 million were recorded for foreign NOL carry

forwards of $828.6 million. A valuation allowance of $146.6 million at December 31, 2010 was recorded

against these deferred tax assets because those assets relate to jurisdictions that have historical losses

and the likelihood exists that a portion of the NOL carry forwards may not be utilized in the future.

The foreign NOL carry forwards of $828.6 million include $692.8 million which have an indefinite carry

forward period and associated deferred tax assets $156.1 million. The remaining foreign NOLs of

$135.8 million are subject to expiration beginning in 2015 and have associated deferred tax assets of

$40.2 million.

As of December 31, 2010, deferred tax assets for U.S. Foreign Tax Credit carry forwards were

$20.8 million which relate to credits generated as of December 31, 2007. The carry forwards will begin to

expire in 2015. A valuation allowance of $13.5 million at December 31, 2010 was recorded against a

portion of the U.S. foreign tax credit deferred tax assets in the likelihood that they may not be utilized in

the future. A deferred tax asset was also recorded for various state tax credit carry forwards of

$3.0 million, which will begin to expire in 2027.

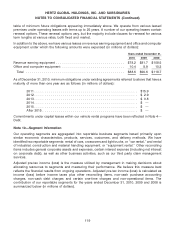

In determining the valuation allowance, an assessment of positive and negative evidence was performed

regarding realization of the net deferred tax assets in accordance with ASC 740-10, ‘‘Accounting for

Income Taxes,’’ or ‘‘ASC 740-10.’’ This assessment included the evaluation of scheduled reversals of

deferred tax liabilities, the availability of carry forwards and estimates of projected future taxable income.

Based on the assessment, as of December 31, 2010, total valuation allowances of $185.8 million were

recorded against deferred tax assets. Although realization is not assured, we have concluded that it is

more likely than not the remaining deferred tax assets of $1,554.8 million will be realized and as such no

valuation allowance has been provided on these assets.

116