Hertz 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 1. BUSINESS (Continued)

depreciation expense in advance, however, typically the acquisition cost is higher for these program

cars.

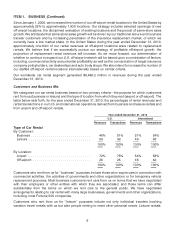

Program cars as a percentage of all cars purchased by our U.S., International and worldwide operations

were as follows:

Years ended December 31,

2010 2009 2008 2007 2006

U.S. ............................................. 54% 48% 55% 42% 61%

International ........................................ 56% 57% 59% 65% 71%

Worldwide ......................................... 55% 51% 57% 50% 64%

We have purchased a significant percentage of our car rental fleet from General Motors Corporation and

its successor, General Motors Company, together ‘‘General Motors.’’ During the year ended

December 31, 2010, approximately 34% of the cars acquired by our U.S. car rental fleet, and

approximately 16% of the cars acquired by us for our international fleet, were manufactured by General

Motors. We have also increased the percentage of our car rental fleet purchased from Toyota Motor

Corporation, or ‘‘Toyota.’’ During the year ended December 31, 2010, approximately 17% of the cars

acquired by our U.S. car rental fleet, and approximately 4% of the cars acquired by us for our

international fleet, were manufactured by Toyota. During the year ended December 31, 2010,

approximately 10% of the cars acquired by us domestically were manufactured by Ford and its

subsidiaries and approximately 24% of the cars acquired by us for our international fleet were

manufactured by Ford and its subsidiaries.

Purchases of cars are financed through cash from operations and by active and ongoing global

borrowing programs. See ‘‘Item 7—Management’s Discussion and Analysis of Financial Condition and

Results of Operations—Liquidity and Capital Resources,’’ in this Annual Report.

We maintain automobile maintenance centers at certain airports and in certain urban and off-airport

areas, which provide maintenance facilities for our car rental fleet. Many of these facilities, which include

sophisticated car diagnostic and repair equipment, are accepted by automobile manufacturers as

eligible to perform and receive reimbursement for warranty work. Collision damage and major repairs

are generally performed by independent contractors.

We dispose of non-program cars, as well as program cars that become ineligible for manufacturer

repurchase or guaranteed depreciation programs, through a variety of disposition channels, including

auctions, brokered sales, sales to wholesalers and dealers and, to a lesser extent and primarily in the

United States, sales at retail through a network of nine company-operated car sales locations dedicated

exclusively to the sale of used cars from our rental fleet.

During 2009, we launched Rent2Buy, an innovative program designed to sell used rental cars. The

program was operating in 28 states as of December 31, 2010. Customers have an opportunity for a

three-day test rental of a competitively priced car from our rental fleet. If the customer purchases the car,

he or she is credited with up to three days of rental charges, and the purchase transaction is completed

through the internet and by mail in those states where permitted.

During the year ended December 31, 2010, of the cars that were not repurchased by manufacturers, we

sold approximately 75% at auction, 11% through dealer direct, 8% through our Rent2Buy program or at

retail locations and approximately 6% through other channels.

12