Hertz 2010 Annual Report Download - page 114

Download and view the complete annual report

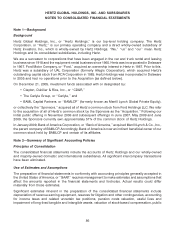

Please find page 114 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

income. The ineffective portion is recognized currently in earnings within the same line item as the

hedged item, based upon the nature of the hedged item. For derivative instruments that are not part of a

qualified hedging relationship, the changes in their fair value are recognized currently in earnings. See

Note 13—Financial Instruments.

Income Taxes

Deferred tax assets and liabilities are recognized for the future tax consequences attributable to

differences between the financial statement carrying amounts of existing assets and liabilities and their

respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected

to apply to taxable income in the years in which those temporary differences are expected to be

recovered or settled. The effect of a change in tax rates is recognized in the statement of operations in

the period that includes the enactment date. Valuation allowances are recorded to reduce deferred tax

assets when it is more likely than not that a tax benefit will not be realized. Subsequent changes to

enacted tax rates and changes to the global mix of earnings will result in changes to the tax rates used to

calculate deferred taxes and any related valuation allowances. Provisions are not made for income taxes

on undistributed earnings of international subsidiaries that are intended to be indefinitely reinvested

outside the United States or are expected to be remitted free of taxes. Future distributions, if any, from

these international subsidiaries to the United States or changes in U.S. tax rules may require a change to

reflect tax on these amounts. See Note 8—Taxes on Income.

Advertising

Advertising and sales promotion costs are expensed as incurred. Advertising costs are reflected as a

component of ‘‘Selling, general and administrative’’ in our consolidated statements of operations and for

the years ended December 31, 2010, 2009 and 2008 were $133.8 million, $113.1 million and

$160.2 million, respectively.

Impairment of Long-Lived Assets and Intangibles

We review goodwill and indefinite-lived intangible assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of the goodwill may not be recoverable, and also review

goodwill annually, using a two-step process. The first step is to identify any potential impairment by

comparing the carrying value of the reporting unit to its fair value. We estimate the fair value of our

reporting units using a discounted cash flow methodology. The cash flows represent management’s

most recent planning assumptions. These assumptions are based on a combination of industry

outlooks, views on general economic conditions, our expected pricing plans and expected future

savings generated by our ongoing restructuring activities. If a potential impairment is identified, the

second step is to compare the implied fair value of goodwill with its carrying amount to measure the

impairment loss. The fair values of the assets are based upon our estimates of the discounted cash

flows. An impairment charge is recognized for the amount, if any, by which the carrying value of an asset

exceeds its implied fair value.

Long-lived assets, other than goodwill and indefinite-lived intangible assets, are tested for impairment

whenever events or changes in circumstances indicate that the carrying amounts of long-lived assets

may not be recoverable. The recoverability of these assets are based upon our estimates of the

undiscounted cash flows that are expected to result from the use and eventual disposition of the assets.

An impairment charge is recognized for the amount, if any, by which the carrying value of an asset

exceeds its fair value.

90