Hertz 2010 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

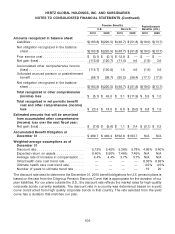

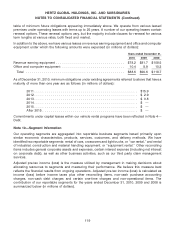

Impact on Results

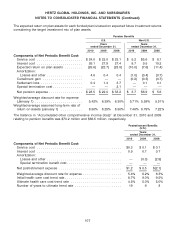

A summary of the total compensation expense and associated income tax benefits recognized under

our Prior Plans and the Omnibus Plan, including the cost of stock options, restricted stock units, or

‘‘RSUs,’’ and performance stock units, or ‘‘PSUs,’’ is as follows (in millions of dollars):

Years ended December 31,

2010 2009 2008

Compensation Expense .................................. $36.6 $ 34.5 $ 27.8

Income Tax Benefit ..................................... (14.2) (13.4) (10.7)

Total .............................................. $22.4 $ 21.1 $ 17.1

As of December 31, 2010, there was approximately $39.8 million of total unrecognized compensation

cost related to non-vested stock options, RSUs and PSUs granted by Hertz Holdings under the Prior

Plans and the Omnibus Plan, including costs related to modifying the exercise prices of certain option

grants in order to preserve the intrinsic value of the options, consistent with applicable tax law, to reflect

special cash dividends of $4.32 per share paid on June 30, 2006 and $1.12 per share paid on

November 21, 2006. The total unrecognized compensation cost is expected to be recognized over the

remaining 1.4 years, on a weighted average basis, of the requisite service period that began on the grant

dates.

Stock Options and Stock Appreciation Rights

All stock options and stock appreciation rights granted under the Omnibus Plan will have a per-share

exercise price of not less than the fair market value of one share of Hertz Holdings common stock on the

grant date. Stock options and stock appreciation rights will vest based on a minimum period of service or

the occurrence of events (such as a change in control, as defined in the Omnibus Plan) specified by the

compensation committee of our Board of Directors. No stock options or stock appreciation rights will be

exercisable after ten years from the grant date.

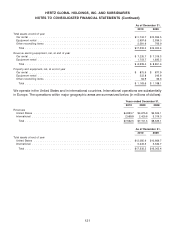

We have accounted for our employee stock-based compensation awards in accordance with ASC 718,

‘‘Compensation—Stock Compensation.’’ The options are being accounted for as equity-classified

awards. We will recognize compensation cost on a straight-line basis over the vesting period. The value

of each option award is estimated on the grant date using a Black-Scholes option valuation model that

incorporates the assumptions noted in the following table. Because the stock of Hertz Holdings became

publicly traded in November 2006 and has a short trading history, it is not practicable for us to estimate

the expected volatility of our share price, or a peer company share price, because there is not sufficient

historical information about past volatility. Therefore, we have used the calculated value method,

substituting the historical volatility of an appropriate industry sector index for the expected volatility of

Hertz Holdings’ common stock price as an assumption in the valuation model. We selected the Dow

Jones Specialized Consumer Services sub-sector within the consumer services industry, and we used

the U.S. large capitalization component, which includes the top 70% of the index universe (by market

value).

The calculation of the historical volatility of the index was made using the daily historical closing values of

the index for the preceding 6.25 years, because that is the expected term of the options using the

simplified approach.

111