Hertz 2010 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2010 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

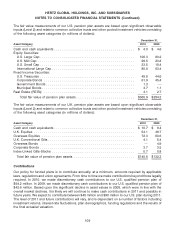

The fair value measurements of our U.S. pension plan assets are based upon significant observable

inputs (Level 2) and relate to common collective trusts and other pooled investment vehicles consisting

of the following asset categories (in millions of dollars):

December 31,

Asset Category 2010 2009

Cash and cash equivalents ........................................ $ 4.0 $ 4.6

Equity Securities:

U.S. Large Cap ............................................... 106.3 80.2

U.S. Mid Cap ................................................ 29.5 23.8

U.S. Small Cap ............................................... 23.5 18.4

International Large Cap ......................................... 80.8 63.4

Fixed Income Securities:

U.S. Treasuries ............................................... 49.8 44.6

Corporate Bonds ............................................. 61.9 45.4

Government Bonds ............................................ 1.3 —

Municipal Bonds .............................................. 4.7 1.1

Real Estate (REITs) ............................................. 4.1 2.7

Total fair value of pension plan assets ............................. $365.9 $284.2

The fair value measurements of our U.K. pension plan assets are based upon significant observable

inputs (Level 2) and relate to common collective trusts and other pooled investment vehicles consisting

of the following asset categories (in millions of dollars):

December 31,

Asset Category 2010 2009

Cash and cash equivalents ........................................ $ 10.7 $ 8.4

U.K. Equities .................................................. 54.1 48.7

Overseas Equities .............................................. 72.3 60.6

U.K. Conventional Gilts ........................................... 4.1 5.4

Overseas Bonds ............................................... — 4.9

Corporate Bonds ............................................... 3.7 3.5

Index-Linked Gilts-Stocks ......................................... 0.7 0.8

Total fair value of pension plan assets .............................. $145.6 $132.3

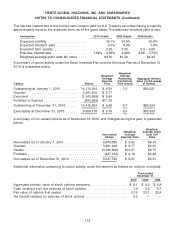

Contributions

Our policy for funded plans is to contribute annually, at a minimum, amounts required by applicable

laws, regulations and union agreements. From time to time we make contributions beyond those legally

required. In 2010, we made discretionary cash contributions to our U.S. qualified pension plan of

$54.2 million. In 2009, we made discretionary cash contributions to our U.S. qualified pension plan of

$42.6 million. Based upon the significant decline in asset values in 2008, which were in line with the

overall market declines, it is likely we will continue to make cash contributions in 2011 and possibly in

future years. We expect to contribute between $45 million and $90 million to our U.S. plan during 2011.

The level of 2011 and future contributions will vary, and is dependent on a number of factors including

investment returns, interest rate fluctuations, plan demographics, funding regulations and the results of

the final actuarial valuation.

109