Hertz 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

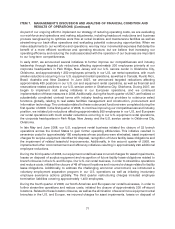

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

assumptions related to volatility, expected term, dividend yield, risk-free interest rate and forfeiture rate.

These factors combined with the stock price on the date of grant result in a fixed expense which is

recorded on a straight-line basis over the vesting period. The key factors used in the valuation process,

other than the forfeiture rate, remained unchanged from the date of grant. Because the stock of Hertz

Holdings became publicly traded in November 2006 and has a short trading history, it is not practicable

for us to estimate the expected volatility of our share price, or a peer company share price, because there

is not sufficient historical information about past volatility. Therefore, we use the calculated value method

to estimate the expected volatility, based on the Dow Jones Specialized Consumer Services sub-sector

within the consumer services industry, and we use the U.S. large capitalization component, which

includes the top 70% of the index universe (by market value). Because historical exercise data does not

exist, and because we meet the requirements of Staff Accounting Bulletin No. 107, we use the simplified

method for estimating the expected term. We believe it is appropriate to continue to use this simplified

method because we do not have sufficient historical exercise data to provide a reasonable basis upon

which to estimate the expected term due to the limited period of time our common stock has been

publicly traded. The assumed dividend yield is zero. The risk-free interest rate is the implied zero-coupon

yield for U.S. Treasury securities having a maturity approximately equal to the expected term of the

options, as of the grant dates. We assume that in each year, 1% of the options that are outstanding but

not vested will be forfeited, based on our U.S. pension plan withdrawal rate assumptions. Considering

the Company’s brief history of issuing stock options and higher than average recent employee turnover,

especially among option holders, we will assess next year if a change in this assumption is warranted.

The non-cash stock-based compensation expense associated with the Hertz Global Holdings, Inc.

Stock Incentive Plan, or the ‘‘Stock Incentive Plan,’’ the Hertz Global Holdings, Inc. Director Stock

Incentive Plan, or the ‘‘Director Plan,’’ and Omnibus Plan, are pushed down from Hertz Holdings and

recorded on the books at the Hertz level. See Note 5 to the Notes to our consolidated financial

statements included in this Annual Report under the caption ‘‘Item 8—Financial Statements and

Supplementary Data.’’

77