Hertz 2008 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

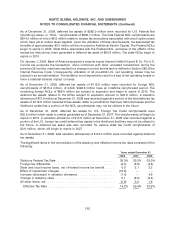

As of December 31, 2008, deferred tax assets of $282.0 million were recorded for U.S. Federal Net

Operating Losses, or ‘‘NOL,’’ carryforwards of $805.7 million. The total Federal NOL carryforwards are

$814.2 million of which $8.5 million relate to excess tax deductions associated with stock option plans

which have yet to reduce taxes payable. Upon the utilization of these carryforwards, the associated tax

benefits of approximately $3.0 million will be recorded to Additional Paid-in Capital. The Federal NOLs

begin to expire in 2025. State NOLs associated with the Federal NOL, exclusive of the effects of the

excess tax deductions, have generated a deferred tax asset of $62.9 million. The state NOLs begin to

expire in 2010.

On January 1, 2009, Bank of America acquired a majority equity interest in Merrill Lynch & Co. For U.S.

income tax purposes the transaction, when combined with other unrelated transactions during the

previous 36 months, may have resulted in a change in control as that term is defined in Section 382 of the

Internal Revenue Code. Consequently, utilization of all pre-2009 U.S. net operating losses may be

subject to an annual limitation. The limitation is not expected to result in a loss of net operating losses or

have a material adverse impact on taxes.

As of December 31, 2008, deferred tax assets of $119.8 million were recorded for foreign NOL

carryforwards of $515.2 million, of which $428.8 million have an indefinite carryforward period. The

remaining foreign NOLs of $86.4 million are subject to expiration and begin to expire in 2015. The

deferred tax assets related to the NOLs subject to expiration amount to $25.6 million. A valuation

allowance of $73.9 million at December 31, 2008 was recorded against a portion of the total deferred tax

assets of $119.8 million because those assets relate to jurisdictions that have historical losses and the

likelihood exists that a portion of the NOL carryforwards may not be utilized in the future.

As of December 31, 2008, deferred tax assets for U.S. Foreign Tax Credit carryforwards were

$20.8 million which relate to credits generated as of December 31, 2007. The carryforwards will begin to

expire in 2015. A valuation allowance of $13.5 million at December 31, 2008 was recorded against a

portion of the U.S. foreign tax credit deferred tax assets in the likelihood that they may not be utilized in

the future. A deferred tax asset was also recorded for various state tax credit carryforwards of

$3.9 million, which will begin to expire in 2027.

As of December 31, 2008, total valuation allowances of $123.2 million were recorded against deferred

tax assets.

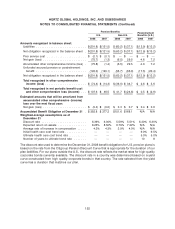

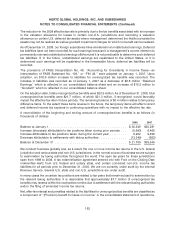

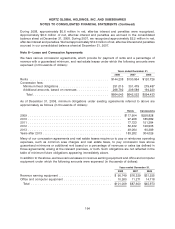

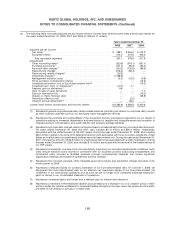

The significant items in the reconciliation of the statutory and effective income tax rates consisted of the

following:

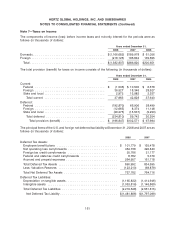

Years ended December 31,

2008 2007 2006

Statutory Federal Tax Rate ............................... 35.0% 35.0% 35.0%

Foreign tax differential ................................... (3.3) (5.6) (4.8)

State and local income taxes, net of federal income tax benefit ..... 0.6 2.1 2.3

Effect of impairment charges .............................. (16.6) — —

Increase (decrease) in valuation allowance .................... (1.0) — 4.9

Change in statutory rates ................................ 0.1 (8.0) (5.4)

All other items, net ..................................... (0.6) 3.0 1.9

Effective Tax Rate .................................... 14.2% 26.5% 33.9%

162