Hertz 2008 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

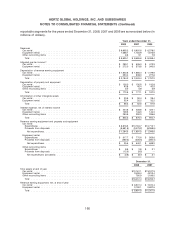

respectively, in depreciation expense related to the net effects of changing depreciation rates to reflect

changes in the estimated residual value of revenue earning equipment.

(10) The first quarter of 2007, second quarter of 2007, third quarter of 2007 and fourth quarter of 2007 include

$32.6 million, $16.7 million, $16.1 million and $31.0 million, respectively, of restructuring charges. See

Note 12—Restructuring.

(11) The first quarter of 2007 includes the write-off of $16.2 million of unamortized debt costs associated with certain

debt modifications and $12.8 million of ineffectiveness on our interest rate swaps.

(12) The first quarter of 2007, second quarter of 2007, third quarter of 2007 and fourth quarter of 2007 include

$12.5 million, $3.3 million, $4.5 million and $5.3 million, respectively, of tax benefit related to the restructuring

charge.

(13) The second quarter of 2007, third quarter of 2007 and fourth quarter of 2007 include decreases of $19.6 million,

$9.2 million and $7.7 million, respectively, in our employee vacation accrual relating to a change in our U.S.

vacation policy which now provides for vacation entitlement to be earned ratably throughout the year versus

the previous policy which provided for full vesting on January 1 of each year.

(14) The second quarter of 2007 includes $12.8 million associated with the reversal of the ineffectiveness of our

interest rate swaps.

(15) The third quarter of 2007 and fourth quarter of 2007 include $17.7 million and $2.7 million, respectively, of

ineffectiveness on our interest rate swaps.

(16) The third quarter of 2007 includes unfavorable tax adjustments of $5.7 million related to prior year periods,

which had a negative impact in the quarter of $0.02 per share on a fully diluted basis. The fourth quarter of 2007

includes net favorable tax adjustments of $5.0 million related to prior year periods, which had a positive impact

in the quarter of $0.02 per share on a fully diluted basis.

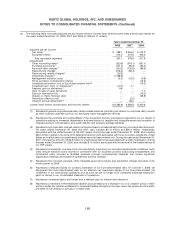

Note 12—Restructuring

As part of our ongoing effort to implement our strategy of reducing operating costs, we are evaluating

our workforce and operations and making adjustments, including headcount reductions and business

process reengineering to optimize work flow at rental locations and maintenance facilities as well as

streamlining our back-office operations and evaluating potential outsourcing opportunities. When we

make adjustments to our workforce and operations, we may incur incremental expenses that delay the

benefit of a more efficient workforce and operating structure, but we believe that increasing our

operating efficiency and reducing the costs associated with the operation of our business are important

to our long-term competitiveness.

In early 2007, we announced several initiatives to further improve our competitiveness and industry

leadership through targeted job reductions affecting approximately 200 employees primarily at our

corporate headquarters in Park Ridge, New Jersey and our U.S. service center in Oklahoma City,

Oklahoma, and approximately 1,350 employees primarily in our U.S. car rental operations, with much

smaller reductions occurring in our U.S. equipment rental operations, as well as in Canada, Puerto Rico,

Brazil, Australia and New Zealand. In June 2007, we announced targeted reductions affecting

approximately 480 positions in our U.S. car and equipment rental operations, as well as financial and

reservations-related positions in our U.S. service center in Oklahoma City, Oklahoma. During 2007, we

began to implement cost saving initiatives in our European operations, and we continued

implementation of these measures in 2008. Additionally, during the fourth quarter of 2007, we finalized or

substantially completed contract terms with industry leading service providers to outsource select

functions globally, relating to real estate facilities management and construction, procurement and

information technology. The contracts related to these outsourced functions were completed during the

first quarter of 2008. In the first quarter of 2008, to continue improving our competitiveness and industry

position, we initiated job reductions affecting approximately 950 employees in our U.S. and European

car rental operations with much smaller reductions occurring in our U.S. equipment rental operations,

the corporate headquarters in Park Ridge, New Jersey, and the U.S. service center in Oklahoma City,

Oklahoma.

176