Hertz 2008 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

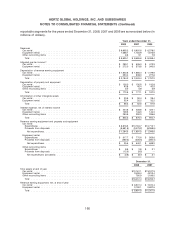

HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

We have accounted for our employee stock-based compensation awards in accordance with SFAS

No. 123R. The options are being accounted for as equity-classified awards. We will recognize

compensation cost on a straight-line basis over the vesting period. The value of each option award is

estimated on the grant date using a Black-Scholes option valuation model that incorporates the

assumptions noted in the following table. Because the stock of Hertz Holdings became publicly traded in

November 2006 and has a short trading history, it is not practicable for us to estimate the expected

volatility of our share price, or a peer company share price, because there is not sufficient historical

information about past volatility. Therefore, we have used the calculated value method, substituting the

historical volatility of an appropriate industry sector index for the expected volatility of Hertz Holdings’

common stock price as an assumption in the valuation model. We selected the Dow Jones Specialized

Consumer Services sub-sector within the consumer services industry, and we used the U.S. large

capitalization component, which includes the top 70% of the index universe (by market value).

The calculation of the historical volatility of the index was made using the daily historical closing values of

the index for the preceding 6.25 years, because that is the expected term of the options using the

simplified approach allowed under Staff Accounting Bulletin No. 107.

The risk-free interest rate is the implied zero-coupon yield for U.S. Treasury securities having a maturity

approximately equal to the expected term, as of the grant dates. The assumed dividend yield is zero. We

assume that each year 1% of the options that are outstanding but not vested will be forfeited because of

employee attrition.

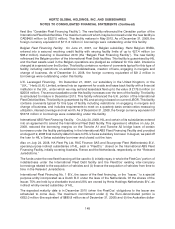

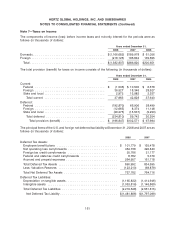

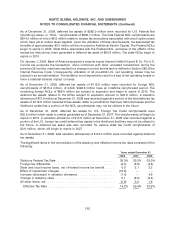

Assumption 2008 Grants 2007 Grants

Expected volatility ................................... 30.8% 39.7% - 50.2%

Weighted-average volatility ............................. 30.8% 46.8%

Expected dividends .................................. 0.0% 0.0%

Expected term (years) ................................ 5.0 - 6.25 5.0 - 6.5

Risk-free rate ....................................... 2.56 - 3.75% 4.38% - 4.79%

Forfeiture rate (per year) .............................. 1.0% 1.0%

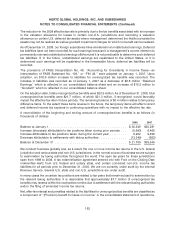

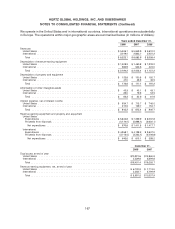

A summary of option activity under the Stock Incentive Plan and the Omnibus Plan as of December 31,

2008 is presented below.

Weighted-

Average

Weighted- Remaining

Average Contractual Aggregate Intrinsic

Exercise Term Value (In thousands

Options Shares Price (years) of dollars)

Outstanding at January 1, 2008 ......... 14,555,331 $ 7.91 8.5 $126,139

Granted .......................... 3,600,488 $11.88

Exercised ......................... (1,218,560) $ 6.04

Forfeited or Expired ................. (849,852) $ 6.88

Outstanding at December 31, 2008 ...... 16,087,407 $ 8.97 7.9 3,987

Exercisable at December 31, 2008 ....... 5,051,656 $ 8.16 7.5 $ 1,504

The weighted average grant date fair value of options granted during the years ended December 31,

2008 and 2007 was $4.42 and $11.16, respectively. The aggregate intrinsic value of options exercised

during the years ended December 31, 2008 and 2007 was $6.8 million and $20.3 million, respectively.

158