Hertz 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

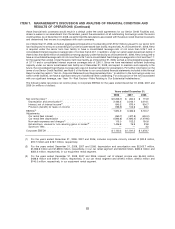

pricing. HERC experienced higher equipment rental volumes and pricing worldwide for the years ended

December 31, 2006 and 2007, with pricing increases in 2007 attributable to higher price activity in

Canada and Europe offsetting lower price activity in the U.S. HERC experienced lower equipment rental

volumes and pricing worldwide for the year ended December 31, 2008. During the years ended

December 31, 2006, 2007 and 2008 (excluding additions relating to acquisitions), HERC had a net

increase of eight and six and a net decrease of 27 U.S. locations, respectively, two, one and two new

Canadian location(s), respectively, and seven, seven and a net decrease of 10 locations in Europe,

respectively, and one location opening in China in 2008. In connection with new location openings in the

U.S., we expect HERC will incur non-fleet start-up costs of approximately $0.8 million per location and

additional fleet acquisition costs, excluding equipment transferred from other branches, over an initial

twelve-month period of approximately $1 to $3 million per location. In connection with new location

openings in Europe, we expect HERC will incur lower start-up costs per location as compared with the

United States.

Critical Accounting Policies and Estimates

Our discussion and analysis of financial condition and results of operations are based upon our

consolidated financial statements, which have been prepared in accordance with accounting principles

generally accepted in the United States of America, or ‘‘GAAP.’’ The preparation of these financial

statements requires management to make estimates and judgments that affect the reported amounts in

our financial statements and accompanying notes.

We believe the following critical accounting policies affect the more significant judgments and estimates

used in the preparation of our financial statements and changes in these judgments and estimates may

impact our future results of operations and financial condition. For additional discussion of our

accounting policies, see Note 1 to the Notes to our consolidated financial statements included in this

Annual Report under the caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Revenue Earning Equipment

Our principal assets are revenue earning equipment, which represented approximately 49% of our total

assets as of December 31, 2008. Revenue earning equipment consists of vehicles utilized in our car

rental operations and equipment utilized in our equipment rental operations. For the year ended

December 31, 2008, 57% of the vehicles purchased for our combined U.S. and international car rental

fleets were subject to repurchase by automobile manufacturers under contractual repurchase and

guaranteed depreciation programs, subject to certain manufacturers’ car condition and mileage

requirements, at a specific price during a specified time period. These programs limit our residual risk

with respect to vehicles purchased under these programs. For all other vehicles, as well as equipment

acquired by our equipment rental business, we use historical experience and monitor market conditions

to set depreciation rates. When revenue earning equipment is acquired, we estimate the period that we

will hold the asset, primarily based on historical measures of the amount of rental activity

(e.g., automobile mileage and equipment usage) and the targeted age of equipment at the time of

disposal. We also estimate the residual value of the applicable revenue earning equipment at the

expected time of disposal. The residual values for rental vehicles are affected by many factors, including

make, model and options, age, physical condition, mileage, sale location, time of the year and channel

of disposition (e.g., auction, retail, dealer direct). The residual value for rental equipment is affected by

factors which include equipment age and amount of usage. Depreciation is recorded on a straight-line

basis over the estimated holding period. Depreciation rates are reviewed on a quarterly basis based on

management’s ongoing assessment of present and estimated future market conditions, their effect on

73