Hertz 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

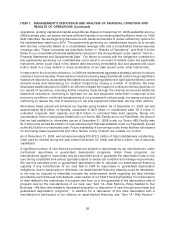

The ratio of adjusted pre-tax income to revenues for our two segments reflects the different

environments in which they operate. Our infrastructure costs are higher within our car rental segment

due to the number and type of locations in which it operates and the corresponding headcount. Within

our equipment rental segment, our revenue earning equipment generates lower depreciation expense

due to its longer estimated useful life.

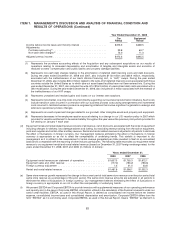

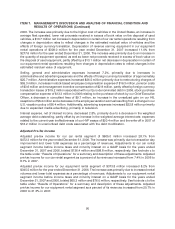

Provision for Taxes on Income, Minority Interest and Net Income

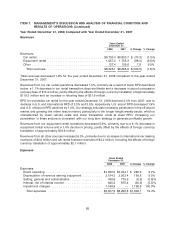

Years Ended

December 31,

2007 2006 $ Change % Change

Income before income taxes and minority interest ....... $386.8 $200.6 $186.2 92.8%

Provision for taxes on income ..................... (102.6) (68.0) (34.6) 50.9%

Minority interest ............................... (19.7) (16.7) (3.0) 17.8%

Net income .................................. $264.5 $115.9 $148.6 128.2%

The provision for taxes on income increased 50.9%, primarily due to an increase in income before

income taxes and minority interest. The effective tax rate for 2007 decreased to 26.5% from 33.9% in

2006, primarily due to a net reduction in the global valuation allowance and a reduction to the net

deferred tax liability attributable to decreases in statutory income tax rates in various jurisdictions. See

Note 7 to the Notes to our consolidated financial statements included in this Annual Report under the

caption ‘‘Item 8—Financial Statements and Supplementary Data.’’

Minority interest increased 17.8% primarily due to an increase in our majority-owned subsidiary

Navigation Solutions, L.L.C.’s net income in 2007 as compared to 2006.

Net income increased 128.2% primarily due to higher rental volume in our worldwide car and equipment

rental operations, partly offset by higher fleet costs, as well as the net effect of other contributing factors

noted above. The impact of changes in exchange rates on net income was mitigated by the fact that not

only international revenues but also most international expenses were incurred in local currencies.

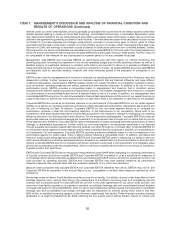

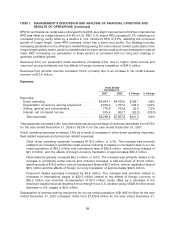

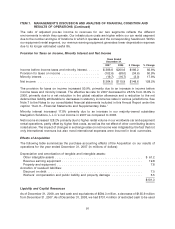

Effects of Acquisition

The following table summarizes the purchase accounting effects of the Acquisition on our results of

operations for the year ended December 31, 2007 (in millions of dollars):

Depreciation and amortization of tangible and intangible assets:

Other intangible assets ................................................ $ 61.2

Revenue earning equipment ............................................ 19.8

Property and equipment ............................................... 7.8

Accretion of revalued liabilities:

Discount on debt .................................................... 7.0

Workers’ compensation and public liability and property damage ................. 5.5

$101.3

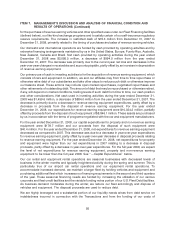

Liquidity and Capital Resources

As of December 31, 2008, we had cash and equivalents of $594.3 million, a decrease of $135.9 million

from December 31, 2007. As of December 31, 2008, we had $731.4 million of restricted cash to be used

91