Hertz 2008 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

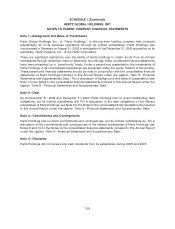

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Sponsor Designees, for so long as Hertz Holdings remains a ‘‘controlled company’’ within the meaning

of the New York Stock Exchange rules), subject to adjustment in the case that the applicable investment

fund sells more than a specified amount of its shareholdings in us. In addition, upon Hertz Holdings

ceasing to be a ‘‘controlled company’’ within the meaning of the New York Stock Exchange rules, if

necessary to comply with the New York Stock Exchange rules, the director nominees of the Sponsors

shall be reduced to two nominees of an investment fund associated with CD&R (one of whom shall serve

as the chairman or, if the chief executive officer is the chairman, the lead director), one nominee of

investment funds associated with Carlyle, and one nominee of an investment fund associated with

MLGPE, and additional independent directors will be elected by our Board of Directors to fill the resulting

director vacancies. The Stockholders Agreement also provides that our chief executive officer shall be

designated as a director, unless otherwise approved by a majority of the Sponsor Designees. In addition,

the Stockholders Agreement provides that one of the nominees of an investment fund associated with

CD&R shall serve as the chairman of the executive and governance committee and, unless otherwise

agreed by this fund, as Chairman of our Board of Directors. On October 12, 2006, our Board elected four

independent directors, effective from the date of the completion of the initial public offering of our

common stock. In order to comply with New York Stock Exchange rules, we will be required to have a

majority of independent directors on our Board of Directors within one year of our ceasing to be a

‘‘controlled company’’ within the meaning of the New York Stock Exchange rules.

The Stockholders Agreement also grants to the investment funds associated with CD&R or to the

majority of the Sponsor Designees the right to remove our chief executive officer. Any replacement chief

executive officer requires the consent of investment funds associated with CD&R as well as investment

funds associated with at least one other Sponsor. It also contains restrictions on the transfer of our

shares, and provides for tag-along and drag-along rights, in certain circumstances. The rights described

above apply only for so long as the investment funds associated with the applicable Sponsor maintain

certain specified minimum levels of shareholdings in us.

In addition, the Stockholders Agreement limits the rights of the investment funds associated with or

designated by the Sponsors that have invested in our common stock and our affiliates, subject to several

exceptions, to own, manage, operate or control any of our ‘‘competitors’’ (as defined in the Stockholders

Agreement). The Stockholders Agreement may be amended from time to time in the future to eliminate

or modify these restrictions without our consent.

Registration Rights Agreement

On the Closing Date, we entered into a registration rights agreement, or, as amended, the ‘‘Registration

Rights Agreement,’’ with investment funds associated with or designated by the Sponsors. The

Registration Rights Agreement grants to certain of these investment funds the right, to cause us, at our

own expense, to use our best efforts to register such securities held by the investment funds for public

resale, subject to certain limitations. The exercise of this right is limited to three requests by the group of

investment funds associated with each Sponsor, except for registrations effected pursuant to Form S-3,

which are unlimited, subject to certain limitations, if we are eligible to use Form S-3. The secondary

offering of our common stock in June 2007 was effected pursuant to this Registration Rights Agreement.

In the event we register any of our common stock, these investment funds also have the right to require

us to use our best efforts to include shares of our common stock held by them, subject to certain

limitations, including as determined by the underwriters. The Registration Rights Agreement also

provides for us to indemnify the investment funds party to that agreement and their affiliates in

connection with the registration of our securities.

185