Hertz 2008 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

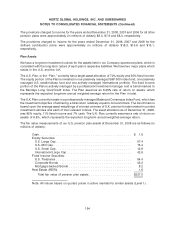

available to HVF on a revolving basis, subject to borrowing base availability. The Series 2008-1 Notes

were not funded on the closing date.

The Series 2008-1 Notes are secured primarily by, among other things, a pledge in (i) collateral owned

by HVF, including substantially all of the U.S. car rental fleet that Hertz uses in its daily rental operations, a

portion of which is subject to repurchase programs with vehicle manufacturers, (ii) the related

manufacturer receivables, (iii) all rights of HVF under a lease agreement between Hertz and HVF relating

to such U.S. car rental fleet, and (iv) all monies on deposit from time to time in certain collection and cash

collateral accounts and all proceeds thereof. The assets of HVF, including the U.S. car rental fleet owned

by HVF, will not be available to satisfy the claims of our general creditors.

The expected final maturity date of the Series 2008-1 Notes is August 2010. The Series 2008-1 Notes

bear interest at variable rates partially based upon their rating. The Series 2008-1 Notes are currently

rated ‘‘A’’ by Standard & Poor’s Ratings Services and ‘‘A3’’ by Moody’s Investors Service.

Pursuant to a note purchase agreement, HVF sold the Series 2008-1 Notes to each of Deutsche Bank

AG, New York Branch, Nantucket Funding Corp. LLC, (an affiliate of Deutsche Bank AG, New York

Branch), Sheffield Receivables Corporation (an affiliate of Barclays Bank PLC), and Merrill Lynch

Mortgage Capital Inc. The Series 2008-1 Notes were issued pursuant to a series supplement to HVF’s

indenture, or the ‘‘Indenture,’’ with The Bank of New York Mellon Trust Company, N.A., as trustee.

The Series 2008-1 Notes are subject to events of default and amortization events that are customary in

nature for U.S. rental car asset-backed securitizations of this type, including non-payment of principal or

interest, violation of covenants, material inaccuracy of representations or warranties, failure to maintain

certain enhancement levels and insolvency or certain bankruptcy events. The occurrence of an

amortization event or event of default could result in the acceleration of principal of the Series 2008-1

Notes and the liquidation of vehicles in the U.S. car rental fleet.

HVF is subject to numerous restrictive covenants under the Indenture and related agreements, including

restrictive covenants with respect to liens, indebtedness, benefit plans, mergers, disposition of assets,

acquisition of assets, dividends, officers compensation, investments, agreements, the types of business

it may conduct and other customary covenants for a bankruptcy-remote special purpose entity.

International Fleet Debt. In connection with the Acquisition, Hertz International, Ltd., or ‘‘HIL,’’ a

Delaware corporation organized as a foreign subsidiary holding company and a direct subsidiary of

Hertz, and certain of its subsidiaries (all of which are organized outside North America), together with

certain bankruptcy-remote special purpose entities (whether organized as HIL’s subsidiaries or as

non-affiliated ‘‘orphan’’ companies), or ‘‘SPEs,’’ entered into revolving bridge loan facilities providing

commitments to lend, in various currencies an aggregate amount equivalent to approximately

$1,565.0 million (calculated as of December 31, 2008), subject to borrowing bases comprised of rental

vehicles and related assets of certain of HIL’s subsidiaries (all of which are organized outside North

America) or one or more SPEs, as the case may be, and rental equipment and related assets of certain of

HIL’s subsidiaries organized outside North America or one or more SPEs, as the case may be. As of the

closing date of the Acquisition, the foreign currency equivalent of $1,781 million of indebtedness under

the International Fleet Debt facilities was issued and outstanding under these facilities. At closing, Hertz

utilized the proceeds from these financings to finance a portion of the Transactions. As of December 31,

2008, the foreign currency equivalent of $1,027.1 million in borrowings was outstanding under these

facilities, net of a $6.5 million discount. These facilities are referred to collectively as the ‘‘International

Fleet Debt’’ facilities.

144