Hertz 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

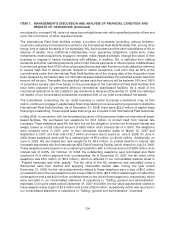

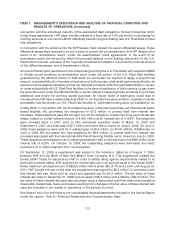

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

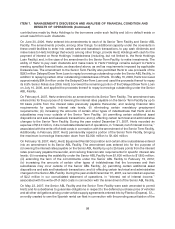

Credit Facilities

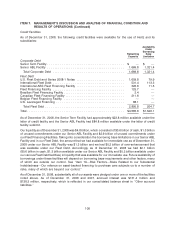

As of December 31, 2008, the following credit facilities were available for the use of Hertz and its

subsidiaries:

Availability

Under

Borrowing

Remaining Base

Capacity Limitation

Corporate Debt

Senior Term Facility .......................................... $ — $ —

Senior ABL Facility .......................................... 1,669.8 1,321.4

Total Corporate Debt ....................................... 1,669.8 1,321.4

Fleet Debt

U.S. Fleet Debt and Series 2008-1 Notes .......................... 1,609.8 79.9

International Fleet Debt ....................................... 531.4 113.3

International ABS Fleet Financing Facility .......................... 326.8 11.5

Fleet Financing Facility ....................................... 125.7 —

Brazilian Fleet Financing Facility ................................. 2.4 —

Canadian Fleet Financing Facility ................................ 211.6 —

Belgian Fleet Financing Facility ................................. — —

U.K. Leveraged Financing ..................................... 88.1 —

Total Fleet Debt ........................................... 2,895.8 204.7

Total ..................................................... $4,565.6 $1,526.1

As of December 31, 2008, the Senior Term Facility had approximately $23.8 million available under the

letter of credit facility and the Senior ABL Facility had $84.8 million available under the letter of credit

facility sublimit.

Our liquidity as of December 31, 2008 was $4.8 billion, which consisted of $0.6 billion of cash, $1.3 billion

of unused commitments under our Senior ABL Facility and $2.9 billion of unused commitments under

our Fleet Financing Facilities. Taking into consideration the borrowing base limitations in our Senior ABL

Facility and in our Fleet Debt, the amount that we had available for immediate use as of December 31,

2008 under our Senior ABL Facility was $1.3 billion and we had $0.2 billion of over-enhancement that

was available under our Fleet Debt. Accordingly, as of December 31, 2008 we had $2.1 billion

($0.6 billion in cash, $1.3 billion available under our Senior ABL Facility and $0.2 billion available under

our various Fleet Debt facilities) in liquidity that was available for our immediate use. Future availability of

borrowings under these facilities will depend on borrowing base requirements and other factors, many

of which are outside our control. See ‘‘Item 1A—Risk Factors—Risks Related to our Substantial

Indebtedness—Our reliance on asset-backed financing to purchase cars subjects us to a number of

risks, many of which are beyond our control.’’

As of December 31, 2008, substantially all of our assets were pledged under one or more of the facilities

noted above. As of December 31, 2008 and 2007, accrued interest was $131.4 million and

$138.3 million, respectively, which is reflected in our consolidated balance sheet in ‘‘Other accrued

liabilities.’’

108