Hertz 2008 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

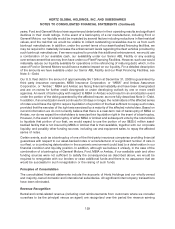

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

separation from Ford, we cannot offer assurance that payments in respect of the indemnification

agreement will be available.

See Note 7—Taxes on Income.

Advertising

Advertising and sales promotion costs are expensed as incurred.

Legal Fees

We accrue for legal fees and other directly related costs of third parties when it is probable that such fees

and costs will be incurred and the amounts can be reasonably estimated.

Impairment of Long-Lived Assets and Intangibles

We review goodwill and indefinite-lived intangible assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of the goodwill may not be recoverable, and also review

goodwill annually, using a two-step process, in accordance with SFAS No. 142, ‘‘Goodwill and Other

Intangible Assets.’’ See Note 2—Goodwill and Other Intangible Assets. The carrying amounts of the

assets are based upon our estimates of the discounted cash flows. An impairment charge is recognized

for the amount, if any, by which the carrying value of an asset exceeds its fair value. Long-lived assets,

other than goodwill and indefinite-lived intangible assets, are reviewed for impairment in accordance

with SFAS No. 144, ‘‘Accounting for the Impairment or Disposal of Long-Lived Assets.’’ Under SFAS

No. 144, these assets are tested for impairment whenever events or changes in circumstances indicate

that the carrying amounts of long-lived assets may not be recoverable. The carrying amounts of the

assets are based upon our estimates of the undiscounted cash flows that are expected to result from the

use and eventual disposition of the assets. An impairment charge is recognized for the amount, if any, by

which the carrying value of an asset exceeds its fair value. During the fourth quarter of 2008, we recorded

non-cash impairment charges totaling $1,168.9 million ($989.0 million, net of tax) related to our goodwill

($694.9 million), other intangible assets ($451.0 million) and property and equipment ($23.0 million).

Stock-Based Compensation

In December 2004, the FASB, revised SFAS No. 123, with SFAS No. 123R, ‘‘Share-Based Payment,’’ or

‘‘SFAS No. 123R.’’ The revised statement requires a public entity to measure the cost of employee

services received in exchange for an award of equity instruments based on the grant-date fair value of

the award. That cost is to be recognized over the period during which the employee is required to

provide service in exchange for the award. Beginning January 1, 2006, we accounted for our employee

stock-based compensation awards in accordance with SFAS No. 123R. We have estimated the fair value

of options issued at the date of grant using a Black-Scholes option-pricing model, which includes

assumptions related to volatility, expected life, dividend yield, risk-free interest rate and forfeiture rate.

See Note 5—Hertz Holdings Stock Incentive Plan.

Use of Estimates and Assumptions

Use of estimates and assumptions as determined by management are required in the preparation of

consolidated financial statements in conformity with accounting principles generally accepted in the

United States of America, or ‘‘GAAP.’’ Actual results could differ materially from those estimates and

assumptions.

133