Hertz 2008 Annual Report Download - page 90

Download and view the complete annual report

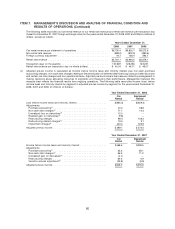

Please find page 90 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (Continued)

commercial construction and the industrial markets slow. The United States and international markets

are currently experiencing a significant decline in economic activities, including a tightening of the credit

markets, reduced airline passenger traffic, reduced consumer spending and volatile fuel prices. These

conditions are expected to continue in 2009. During 2008, this resulted in a rapid decline in the volume of

car rental and equipment rental transactions, an increase in depreciation and fleet related costs as a

percentage of revenue, lower industry pricing and lower residual values for the non-program cars and

equipment that we sold. See ‘‘Item 1A—Risk Factors’’ in this Annual Report.

Our profitability is primarily a function of the volume, mix and pricing of rental transactions and the

utilization of cars and equipment. Significant changes in the purchase price or residual values of cars

and equipment or interest rates can also have a significant effect on our profitability depending on our

ability to adjust pricing for these changes. In the United States, 2007 model year program vehicle

depreciation costs rose approximately 15% and per-car depreciation costs for 2007 model year U.S.

non-program cars declined as compared to 2006. As a consequence of those changes in per-car costs,

as well as the larger proportion of our U.S. fleet we purchased as non-program cars and other actions we

took to mitigate program car cost increases, our net per-car depreciation costs for 2007 model year cars

increased by less than 3% from our net per-car depreciation costs for 2006 model year U.S. cars. We

continue to have an overall strategy of increasing the proportion of non-program cars we have in our

worldwide fleet. However in 2008, given the recent economic downturn described above, we sold a

higher proportion of non-program cars during the third quarter, when the used car market is traditionally

stronger, to reduce exposure to residual value declines in the fourth quarter. Accordingly, for the year

ended December 31, 2008, the percentage of non-program cars in the U.S. fleet decreased from 58% to

46% as compared to the year ended December 31, 2007; however, the percentage of non-program cars

increased slightly internationally and for the year ended December 31, 2008, the percentage of

non-program cars in our international fleet was 41%, compared to 35% for the year ended December 31,

2007.

Our per car vehicle depreciation costs in the United States for 2008 increased approximately 6% from

our net per car depreciation costs for 2007 and increased approximately 20% in Europe year-over-year.

We expect our per car vehicle depreciation costs in the United States and in Europe for 2009 to be similar

to 2008. Our business requires significant expenditures for cars and equipment, and consequently we

require substantial liquidity to finance such expenditures. See ‘‘Liquidity and Capital Resources’’ below.

Our car rental and equipment rental operations are seasonal businesses, with decreased levels of

business in the winter months and heightened activity during the spring and summer. We have the ability

to dynamically manage fleet capacity, the most significant portion of our cost structure, to meet market

demand. For instance, to accommodate increased demand, we increase our available fleet and staff

during the second and third quarters of the year. As business demand declines, fleet and staff are

decreased accordingly. A number of our other major operating costs, including airport concession fees,

commissions and vehicle liability expenses, are directly related to revenues or transaction volumes. In

addition, our management expects to utilize enhanced process improvements, including efficiency

initiatives and the use of our information technology systems, to help manage our variable costs.

Approximately two-thirds of our typical annual operating costs represent variable costs, while the

remaining one-third is fixed or semi-fixed. We also maintain a flexible workforce, with a significant

number of part time and seasonal workers. However, certain operating expenses, including minimum

concession fees, rent, insurance, and administrative overhead, remain fixed and cannot be adjusted for

seasonal demand.

70