Hertz 2008 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HERTZ GLOBAL HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

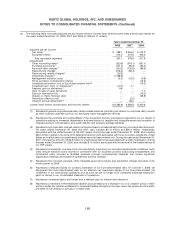

In late May and June 2008, our U.S. equipment rental business initiated the closure of 22 branch

operations across the United States to gain further operating efficiencies. This initiative resulted in

severance costs for approximately 180 employees whose positions were eliminated, asset impairment

charges for surplus equipment identified for disposal, recognition of future facility lease obligations and

the impairment of related leasehold improvements. Additionally, in the second quarter of 2008, we

implemented other cost containment and efficiency initiatives resulting in approximately 220 additional

employee reductions.

During the third quarter of 2008, our equipment rental business incurred charges for asset impairments,

losses on disposal of surplus equipment and recognition of future facility lease obligations related to

branch closures in the U.S. and Europe. Our U.S. car rental business, in order to streamline operations

and reduce costs, initiated the closure of 48 off-airport locations and incurred a charge related to facility

lease obligations. Additionally, to address the challenging economic environment, we introduced a

voluntary employment separation program in our U.S. operations as well as initiating involuntary

employee severance actions globally. The third quarter restructuring charges included employee

termination liabilities covering approximately 1,400 employees.

During the fourth quarter of 2008, our North American and European car rental businesses, in order to

further streamline operations and reduce costs, initiated the closure of approximately 200 off-airport

locations. Related to these location closures, as well as the elimination of several more equipment rental

branches in the U.S. and Europe, we incurred charges for asset impairments, losses on disposal of

surplus vehicles and equipment and recognition of future facility lease obligations for those locations

vacated by year-end. The locations closed were strategically selected to enable us to continue to

provide our rental services from other locations in the same area to our loyal customer base. We will

continue to assess the effectiveness, size and geographical presence of our global network footprint and

may make adjustments as warranted. In January 2009, we announced that, as part of a comprehensive

plan to further decrease costs and as a result of reduced rental demand, we were reducing our global

workforce by more than 4,000 employees beginning in the fourth quarter 2008 and continuing through

the first quarter of 2009, more than half of whom are not eligible for severance benefits. We expect job

reductions in the car and equipment rental businesses, corporate and support areas, and in all

geographies, with an emphasis on eliminating non-customer facing jobs. Related to these location

closures and continued cost reduction initiatives, we incurred restructuring charges for employee

termination liabilities covering approximately 1,500 employee separations in the fourth quarter.

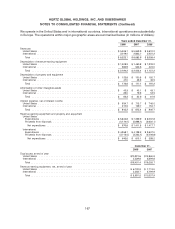

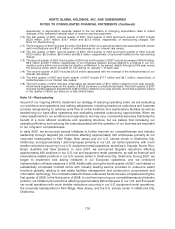

For the year ended December 31, 2008, our consolidated statement of operations includes restructuring

charges relating to the initiatives discussed above of $216.1 million, which is composed of $83.8 million

of termination benefits, $89.1 million in asset impairment charges, $14.1 million in facility closure and

lease obligation costs, $4.0 million in facility fixed asset and inventory impairment costs, $10.0 million in

consulting costs, $5.6 million in pension settlement losses and $9.5 million of other restructuring

charges. The after-tax effect of the restructuring charges reduced diluted earnings per share by $0.48 for

the year ended December 31, 2008.

For the year ended December 31, 2007, our consolidated statement of operations includes restructuring

charges relating to the initiatives discussed above of $96.4 million, which is composed of $65.2 million of

involuntary termination benefits, $21.7 million in consulting costs, a net gain of $0.4 million related to

pension and post employment benefits and other charges of $9.9 million. The after-tax effect of the

restructuring charges reduced diluted earnings per share by $0.22 for the year ended December 31,

2007.

Additional efficiency and cost saving initiatives may be developed during 2009. However, we presently

do not have firm plans or estimates of any related expenses.

177