Hertz 2008 Annual Report Download - page 248

Download and view the complete annual report

Please find page 248 of the 2008 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

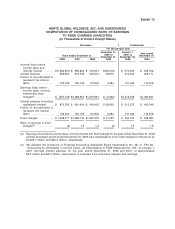

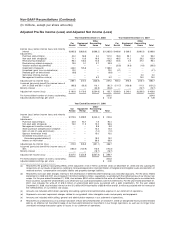

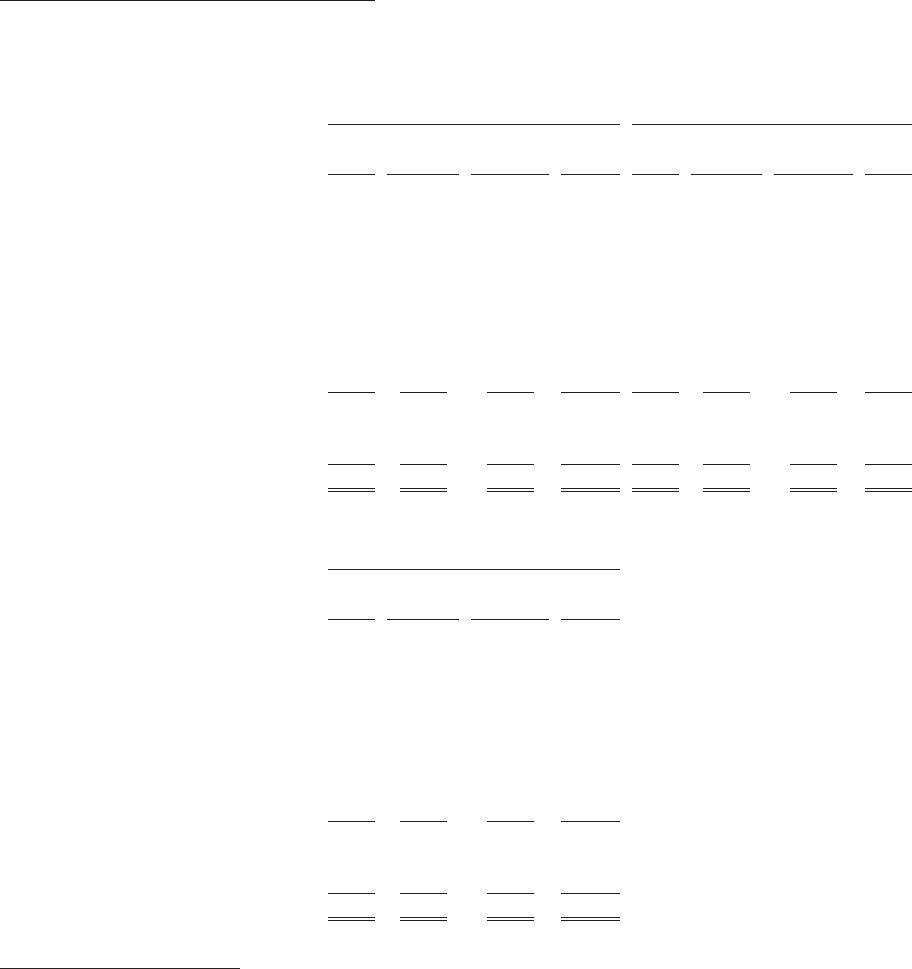

Non-GAAP Reconciliations (Continued)

(In millions, except per share amounts)

Adjusted Pre-Tax Income (Loss) and Adjusted Net Income (Loss)

Year Ended December 31, 2008 Year Ended December 31, 2007

Other Other

Car Equipment Reconciling Car Equipment Reconciling

Rental Rental Items Total Rental Rental Items Total

Income (loss) before income taxes and minority

interest ....................... $(385.3) $(629.3) $(368.2) $(1,382.8) $ 468.6 $ 308.5 $(390.3) $ 386.8

Adjustments:

Purchase accounting(a) .............. 40.2 58.8 2.0 101.0 35.3 58.1 1.8 95.2

Non-cash debt charges(b) ............ 71.1 10.3 18.8 100.2 66.5 11.2 28.2 105.9

Restructuring charges(c) ............. 98.4 103.2 14.6 216.2 64.5 4.9 27.0 96.4

Restructuring related charges(c) ......... 19.5 3.1 3.7 26.3 — — — —

Vacation accrual adjustment(c) .......... — — — — (25.8) (8.9) (1.8) (36.5)

Impairment charges(d) .............. 443.0 725.9 — 1,168.9 — — — —

Unrealized (gain) loss on derivative(e) ...... 12.0 — — 12.0 (4.1) — — (4.1)

Realized gain on derivative(e) .......... (9.8) — — (9.8) — — — —

Secondary offering costs(e) ............ — — — — — — 2.0 2.0

Management transition costs(e) ......... — — 5.2 5.2 — — 15.0 15.0

Adjusted pre-tax income (loss) ........... 289.1 272.0 (323.9) 237.2 605.0 373.8 (318.1) 660.7

Assumed (provision) benefit for income taxes of

34% in 2008 and 35% in 2007 .......... (98.3) (92.5) 110.1 (80.7) (211.7) (130.8) 111.3 (231.2)

Minority interest .................... — — (20.8) (20.8) — — (19.7) (19.7)

Adjusted net income (loss) ............. $190.8 $ 179.5 $(234.6) $ 135.7 $ 393.3 $ 243.0 $(226.5) $ 409.8

Pro forma diluted number of shares outstanding . 325.5 324.8

Adjusted diluted earnings per share ........ $ 0.42 $ 1.26

Year Ended December 31, 2006

Other

Car Equipment Reconciling

Rental Rental Items Total

Income (loss) before income taxes and minority

interest ....................... $373.5 $ 269.5 $(442.4) $ 200.6

Adjustments:

Purchase accounting(a) .............. 23.8 64.7 1.9 90.4

Non-cash debt charges(b) ............ 75.0 11.3 13.2 99.5

Management transition costs(e) ......... — — 9.8 9.8

Stock purchase compensation charge(e) .... — — 13.3 13.3

Gain on sale of swap derivative(e) ........ — — (1.0) (1.0)

Sponsor termination fee(e) ............ — — 15.0 15.0

Unrealized transaction loss on

Euro-denominated debt(e)(f) .......... — — 19.2 19.2

Interest on HGH debt ............... — — 39.9 39.9

Adjusted pre-tax income (loss) ........... 472.3 345.5 (331.1) 486.7

Assumed (provision) benefit for income taxes of

35% ......................... (165.3) (120.9) 115.9 (170.3)

Minority interest .................... — — (16.7) (16.7)

Adjusted net income (loss) ............. $307.0 $ 224.6 $(231.9) $ 299.7

Pro forma diluted number of shares outstanding . 324.8

Adjusted diluted earnings per share ........ $ 0.92

(a) Represents the purchase accounting effects of the acquisition of all of Hertz’s common stock on December 21, 2005 and any subsequent

acquisitions on our results of operations relating to increased depreciation and amortization of tangible and intangible assets and accretion of

revalued workers’ compensation and public liability and property damage liabilities.

(b) Represents non-cash debt charges relating to the amortization of deferred debt financing costs and debt discounts. For the years ended

December 31, 2008 and 2007, also includes $11.8 million and $20.4 million, respectively, associated with the ineffectiveness of our interest rate

swaps. For the year ended December 31, 2008, also includes $30.0 million related to the write-off of deferred financing costs associated with

those countries outside the United States as to which take-out asset-based facilities were not entered into. For the year ended December 31,

2007, also includes the write-off of $16.2 million of unamortized debt costs associated with a debt modification. For the year ended

December 31, 2006, also includes interest on the $1.0 billion HGH loan facility of $39.9 million and $1.0 million associated with the reversal of

the ineffectiveness of our interest rate swaps.

(c) Amounts are included within direct operating and selling, general and administrative expense in our statement of operations.

(d) Represents non-cash impairment charges related to our goodwill, other intangible assets and property and equipment.

(e) Amounts are included within selling, general and administrative expense in our statement of operations.

(f) Represents an unrealized loss on currency translation of Euro-denominated debt. On October 1, 2006, we designated this Euro-denominated

debt as an effective net investment hedge of our Euro-denominated net investment in our foreign operations, as such we no longer incur

unrealized exchange transaction gains or losses in our statement of operations.